Has your business achieved Product-Market-Fit?

Is your business processing at least $100k of payments per month?

Does your product have high-growth plans or new market entry?

If your answer to these questions is 'yes,' it is high time you take control of your payments. Payments are the backbone of your business, and taking control of it has immense business value.

Why should you take control of your payments?

Traditional payment processors make it challenging to customize the payment experience. Nor do they offer a modern, native payment experience resulting in low conversion rates. While the new-age payment facilitators (Eg. Stripe, Braintree, Adyen, etc.) score better on developer experience, they treat payments as a black box. As a result, the developer or the product owner has no control or visibility over payments - what started as a happy marriage gets sour soon. So, taking control of your payments is essential to:

- Grow with Freedom and Flexibility: Avoid getting locked in with a single payment processor. A single processor rarely meets all the requirements of growing businesses.

- Improve Payment Conversions: You can only improve what you have control over. (Read our blog here.)

- Optimize Payment Costs: With the proper controls, you can reduce costs. (Read our blog here.)

- Future-proof your business: You can enter new markets or launch new products quickly with complete control over your payments.

- Customize the payment experience: You won't be a the mercy of your payment processor with respect to the payment UX. You can customize it by market, product, or even customer cohorts. You can make the payment experience aligned 100% with your brand guidelines.

- Owning the data: With a single payment processor, your payment data is locked in a third-party vault. Without a compliance burden, you could own your payment data.

What should you take control of in payments?

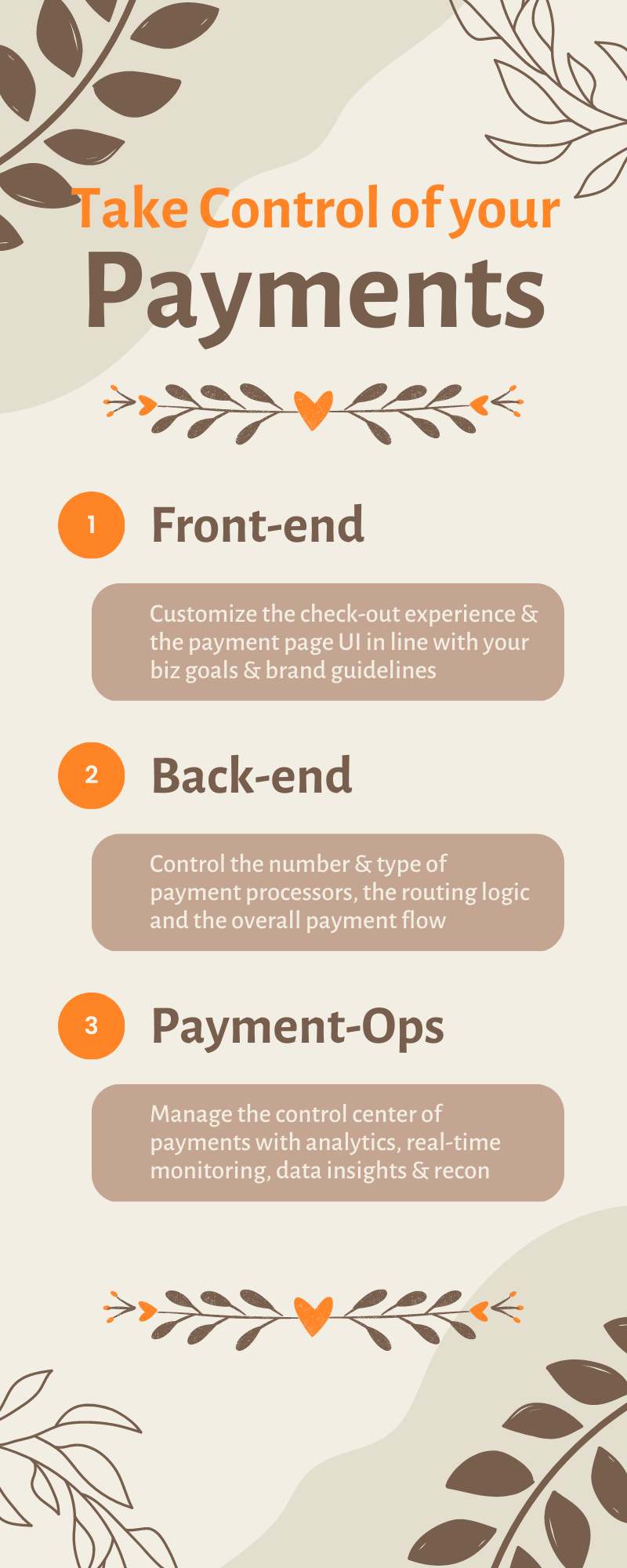

Taking control of payments can happen at three levels for your product:

- Level 1: Customer Experience in Payments (The Front-end)

- Level 2: Payment Processing behind the scene (The Back-end)

- Level 3: Data, reporting, and deep analytics (The Payment Ops)

Level 1: The Front-end

Front-end impacts your customer experience and, ultimately, the conversion rates. While there are some good practices, there is no one-size-fits-all solution. So, it is critical you control the customer front-end. It has two sub-elements:

- The Checkout experience: Offer a smooth, cross-platform checkout experience (across mobile app, mobile site, desktop site, etc.) The complexity of your offering determines the checkout process. While a single-step checkout is preferred, it is better to break them to reduce the user's cognitive load, especially for mobile devices. Technically, there are three ways to implement:

- Native Checkout: (aka In-App Checkout) Entire customer interactions happen within your app. It gives the best checkout experience in mobile apps. The experience is seamless, from shopping to paying. There are no redirections or abnormal scaling of web pages. It needs a platform-specific implementation - Eg. iOS, Android, Web, etc.

- Embedded Checkout: This method accomplishes payment using an iframe or widget within your app or website. The user is still on your site. The experience won't be as smooth as a Native Checkout, but it is usually better than a redirection flow. The experience gets compromised when there is 2-factor authentication with non-uniform page scaling.

- Redirected Checkout: The user is redirected to the payment processor's page. While it is easy to implement, it doesn't offer a unified payment experience.

- UI of the Checkout Page: The actual design of the page should not be overlooked. You should align the checkout page with your brand guidelines. Eg.

- Colors & Aesthetics

- Fonts & Styling

- Layouts & Sequencing

- Presentation of third-party logos

Level 2: The Back-end

The back end determines your overall processing cost and payment conversion rates. Its critical dimensions you should control:

- Payment Processors: This is the most crucial dimension to control. You should configure the number of processors and their mapping to payment methods, markets, currencies, etc.

- Payment Routing: You can configure routing rules to meet business goals. For example, the goal could be to optimize processing costs, maximize conversion rates, or reduce fraud rates. Another important use case is to allocate volumes to different processors per the contractual volume commitment.

- Payment Flow: Controlling the payment flow involves decisions like when to (a) use specialized fraud engines, (b) present saved payment methods, (c) apply additional factors of authentication, etc. Additionally, you want to control how systems like ERP, Accounting platforms, etc., will consume the payment data.

Level 3: Payment-Ops

This is the control center for your overall payments. It is a 24x7 activity, and having a robust data & analytics platform massively enhances business value and reduces manual effort. It encompasses:

- Core Analytics: It should cover core metrics like payment, transaction volume, success rates, and refunds by various dimensions, including the performance of different processors and payment methods.

- Real-time Monitoring: The ability to monitor real-time performance helps take corrective actions quickly.

- Alerts, Notifications & Reports: You should set alerts, notifications, and scheduled reports for timely action.

- Data Insights & Recommendations: Choose or configure platforms that provide insights and recommendations to improve business metrics like conversion rates.

- Reconciliation: When there are multiple processors, reconciliation is essential, and getting a customizable view is critical.

Tools like Hyperswitch lets you take complete control of your payments. It is open source, fast, and free to get started. Try it today.

Key Takeaways

Taking control of payments is vital to growing and established businesses. It helps to gain freedom, improve conversion, reduce cost, and future-proof your business. Take control of all three levels of payment: the user-experience layer, the back-end processing layer, and back-office payment ops.