“Every abundance creates a new scarcity”

- Chris Anderson,

The Payments Ecosystem

Growth in digital payments adoption can be attributed largely to the diversity that has evolved in the payment ecosystem. This has led to an explosion of payment methods and payment processors to the extent that payment solutions have turned into a commodity, i.e. they are not very differentiated from one another. In other words there is an abundance of payment processors. Given this abundance of payment processors and the evolving nature of the payments ecosystem, it can be really hard to narrow down and build the payment stack that scales with your business. Control and optimization of your payment stack is the scarcity created in this new age of payment diversity and processor abundance. This is where payment orchestrators come into the picture.

To fully benefit from this diversity, your business needs a system to leverage multiple features offered by processors, improve conversion rates, reduce payment processing costs and constantly upgrade your payment stack with new age payment methods. A payment orchestrator can be used as your doorway into the entire payment ecosystem. It enables you to integrate with multiple payment processors with a single API integration. This saves you months of developer effort and gives you room for experimentation. This is also a good way to not lock yourself onto a single payment processor. Many businesses understand this and integrate at least two to three payment processors to ensure sufficient fallbacks. You cannot let processor downtimes have an impact on your GMV or orders.

What can orchestrators do?

An orchestrator can seamlessly route every incoming transaction dynamically or with certain preset rules as per your business objective. You could choose to optimize for cost, conversion rates or set up routes based on transaction volumes among other options. Here are some factors that you might want to consider to make a payment routing decision:

- Cost: There is a substantial difference in the processing fees for the same payment method across different payment processors

- Conversion rates: Certain payment processors have good conversion rates for certain payment methods and the success rates differ considerably across different processors

- Downtimes: Downtimes can occur for a variety of reasons like sudden increase in transaction volumes, being flagged by the processor for potential risk in the nature of transaction and so on. It is important to have a fallback processor for such situations

- Load balancing: Orchestrators can come in handy for balancing your transaction loads across multiple processors especially for special events like a flash sale on your website

- Business use cases: You might want to route transactions to different processors based on factors like product category, offers, pay later options, type of transaction (auth and capture, installments, subscriptions) etc.

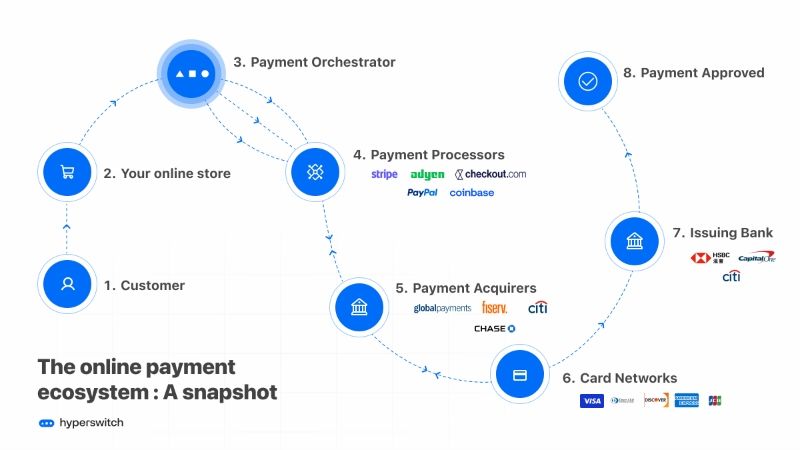

Here's a snapshot of how an orchestrator fits into the payment journey

Different Steps in your Payment Journey and the role of Payment Orchestrator in it:

1. A consumer adds a product (or service) to their shopping cart on an online merchant's website and proceeds to the checkout page.

2. At the checkout, the customer chooses their preferred payment method from the list of options.

3. The payment details are encrypted and securely transmitted to the payment gateway for processing.

The payment orchestrator, at this point, employs static routing configurations based on different factors to optimize the payment process:

- Volume-Based Configuration: The orchestrator routes transactions to specific payment processors based on the percentage pre-defined by the merchant.

- Rule-Based Configuration: The orchestrator follows predefined rules set by the merchant to route transactions. For example, certain payment methods, amounts, or billing locations can be directed to specific processors based on business policies or partnerships.

- Cost-Based Configuration: Payment orchestrators consider transaction costs when selecting payment processors. The configuration is optimized for connector spends and conversion rates on top of fallback.

4. The selected payment processor forwards the encrypted payment information to the acquiring bank and payment processor for further verification.

5. The acquiring bank communicates with the issuing bank to validate and authorize the payment request.

6. Simultaneously, the payment orchestrator employs advanced fraud detection mechanisms. It analyzes transaction patterns, customer behavior, and other variables to identify and prevent potential fraudulent activities in real time.

7. By catching and stopping fraudulent transactions at this stage, the payment orchestrator ensures the security of legitimate transactions and protects both the customers and the merchants.

8. If the payment is successfully authorized, the acquiring bank sends an approval response to the payment gateway and the merchant, allowing the transaction to be completed.

9. In the event of a payment failure, the payment orchestrator automatically reroutes the same payment request to another pre-configured payment processor, based on the routing rules. This strategic approach reduces the number of false declines and improves the likelihood of a successful payment approval.

Benefits of Payment Orchestrator:

| Business | Merchant | Users |

| Streamlined Payment Processing | Seamless Checkout Experience | Multiple Payment Options |

| Increased Efficiency | Higher Conversion Rates | Faster Checkout |

| Reduced Integration Efforts | Real-Time Insights and Reporting | Enhanced Security |

| Enhanced Security | Recurring Billing Support | Minimized Payment Failures |

| Improved Fraud Detection | Easy Integration with Existing Systems | Seamless Mobile Experience |

| Access to Various Payment Methods | Efficient Dispute Resolution | Seamless Cross-Border Payments |

Practical usage of Payment Orchestration

Let’s get into some basic operational details of using an orchestrator. You would want to start with configuring all the payment processors that you wish to add to your stack. This would be a one time step where you would sync up your orchestrator with your processors. You would then assign priorities to each processor. This would help your orchestrator ensure there is a fallback. The next step would be to assign a more nuanced priority logic that distributes the incoming transaction volume based on what your business chooses to optimize for. If your objective is to reduce processing fees, you would route all incoming transactions to the most economic processor. Alternatively, if your objective is to improve payment conversion at any cost, you would set a custom rule that routes all transactions to the most reliable processor. This has to be done at the level of each payment method.

This is what is known as static routing, where transactions are routed based on a set of preset conditions. Some orchestrators would also be able to provide you with dynamic routing options. In this case the orchestrator would constantly monitor and learn from the payment failure patterns across the ecosystem and make fully automatic routing decisions in the context of your business. Payment processors are constantly evaluated for their health and decisions are made accordingly. You should ideally still have the option to bypass everything and route transactions only based on your business logic.

Choosing an orchestrator

The primary goal of setting up an orchestrator is to reduce developer effort and set up a payment stack that scales. You would ideally want a solution that does not get in the way of your core business focus. Having said that, here are a few key parameters that you should consider:

- Ease of integration: Ideally you would want to experiment with different options before finalizing on a particular solution. Some orchestrators do not have a self sign up and require you to reach out to their team. It shouldn’t require elaborate effort and multiple sales pitches for you to be able to just plug and play with one

- User friendliness: The dashboard is your window into your payment stack. It is super important that you have a dashboard designed to balance ease of use and flexibility

- Requirement of domain knowledge: What level of payment domain knowledge is your orchestrator demanding? It is usually not a great sign if you find yourself stuck amidst payment processing jargon. You need to be able to take full control of your payments form the moment you integrate

- Processor coverage: Though many orchestrators might claim to support hundreds of payment processors, it is important to identify if it supports your current processor and your context-specific use cases

- UI customization: This is a bare minimum requirement because this is the orchestrator’s interface with your customers. Does your orchestrator provide an SDK? Does the SDK provide you with enough flexibility to customize the checkout experience for your customers? Are you able to provide a unified experience across web and mobile platforms?

- Dynamic updates: The payments ecosystem is constantly evolving and you would ideally want to decouple your payment stack's updates from your application’s release cycle. This means your payment SDK must support dynamic over the air updates. This is enables customers update the SDK without having to install updates from app stores

Overall you would want to pick a reliable orchestrator and be mindful of the other value added services they have to offer. It might happen that some orchestrators are payment processors themselves. In such cases you would have to ensure that there is no inherent bias when it comes to the routing process.

Making payments fast, reliable and affordable

There is a clear shift in human culture towards a more egalitarian, community-oriented pattern. This implies a shift in decision making power from centralized entities to the larger community. We believe that this shift is coming to disrupt the payments ecosystem as well. There has been a noticeable stagnation in payments innovation over the last few years because payment solutions have been traditionally controlled by large corporations. We believe this pattern needs to be broken. Payments are a basic need for the internet economy. Payments should be Open, Fast, Efficient & Affordable to serve billions of people at scale. This is why we built as an open source payments switch. Hyperswitch is built by the community and our roadmap is open for everyone to access. If this mission of making payments fast, reliable and affordable resonates with you, do check out