Financial precision with

unified & automated

reconciliation

Automated 3-way reconciliation across your payment data, PSPs, and banks that saves time, reduces errors, and gets you complete visibility into your cash flows.

Trusted by the fastest growing businesses globally

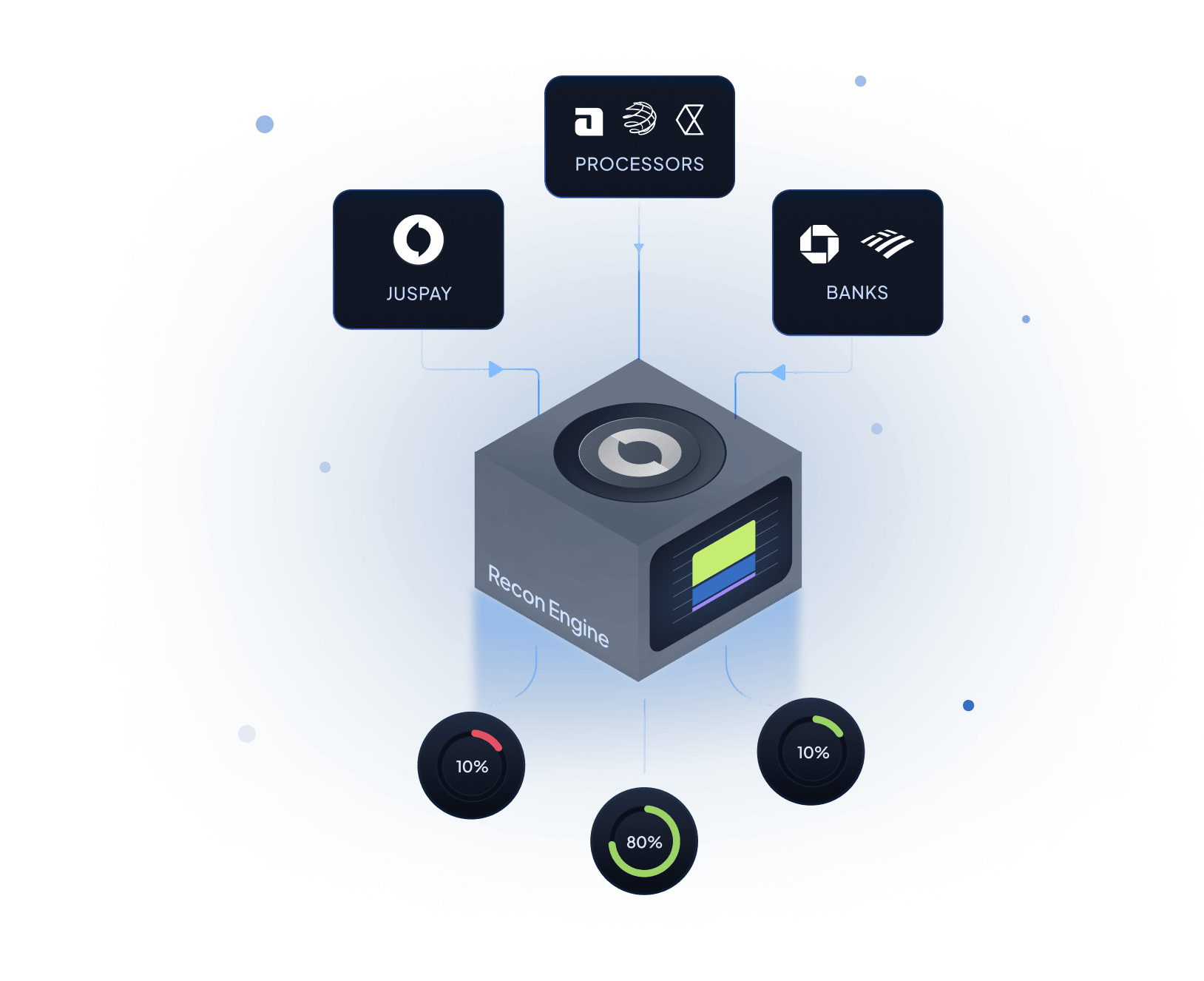

Support multiple data sources & formats

Juspay's automated reconciliation engine instantly flags mismatched or missing records. Merchants can analyse and resolve mismatches seamlessly from a unified dashboard.

API based connectors

and data pipelines to streamline the flow of information between multiple systems

Schema mapping

Techniques & data transformation tools for consistent interpretation and processing

Industry-standard protocols

Such as RESTful APIs, GraphQL, or WebSockets to ensure standardization & efficiency

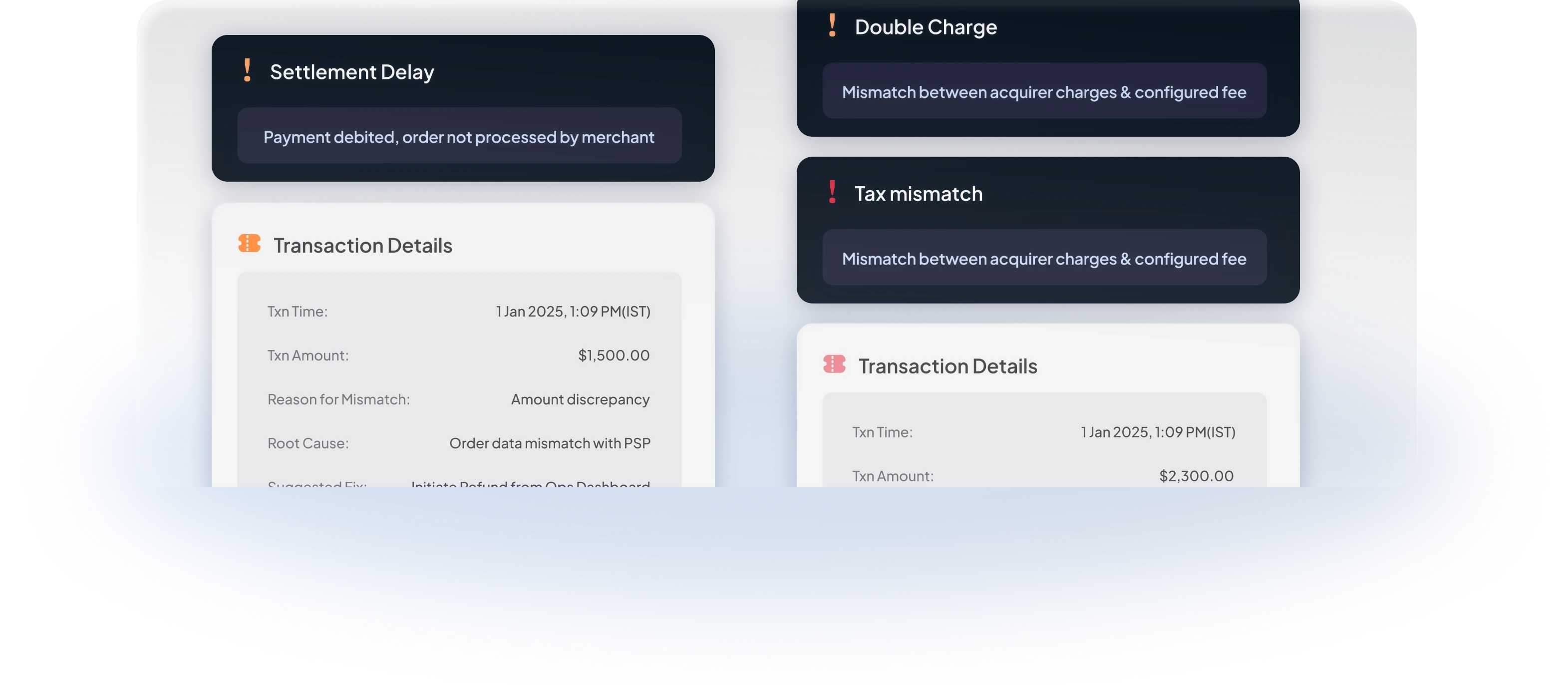

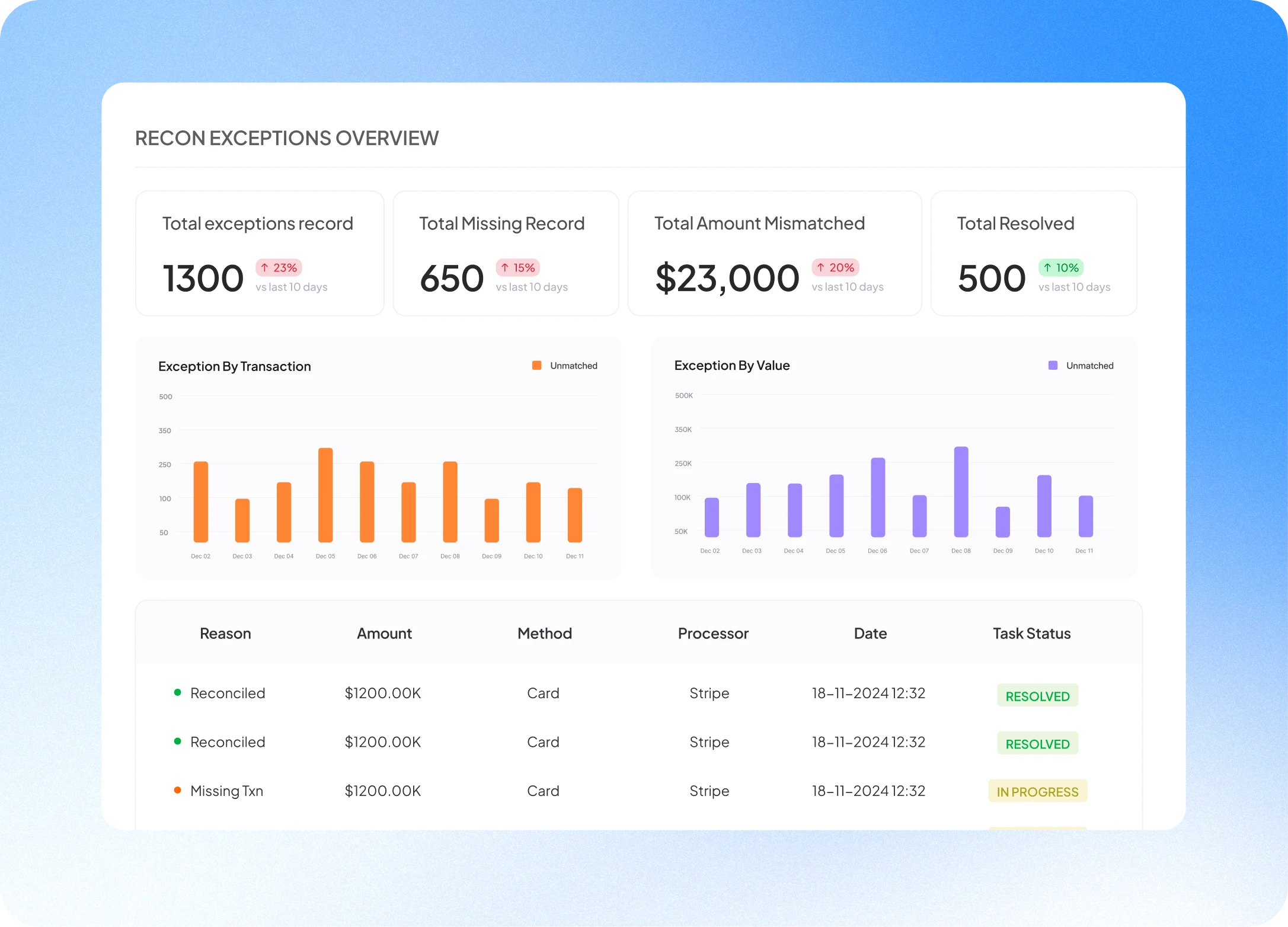

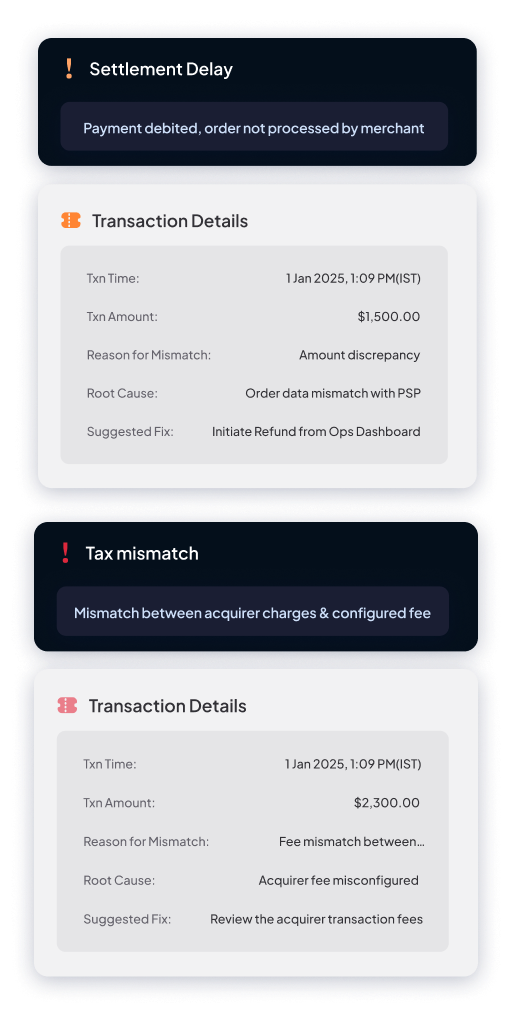

Automated exception detection & management

Juspay's automated reconciliation engine instantly flags mismatched or missing records. Merchants can analyse and resolve mismatches seamlessly from a unified dashboard.

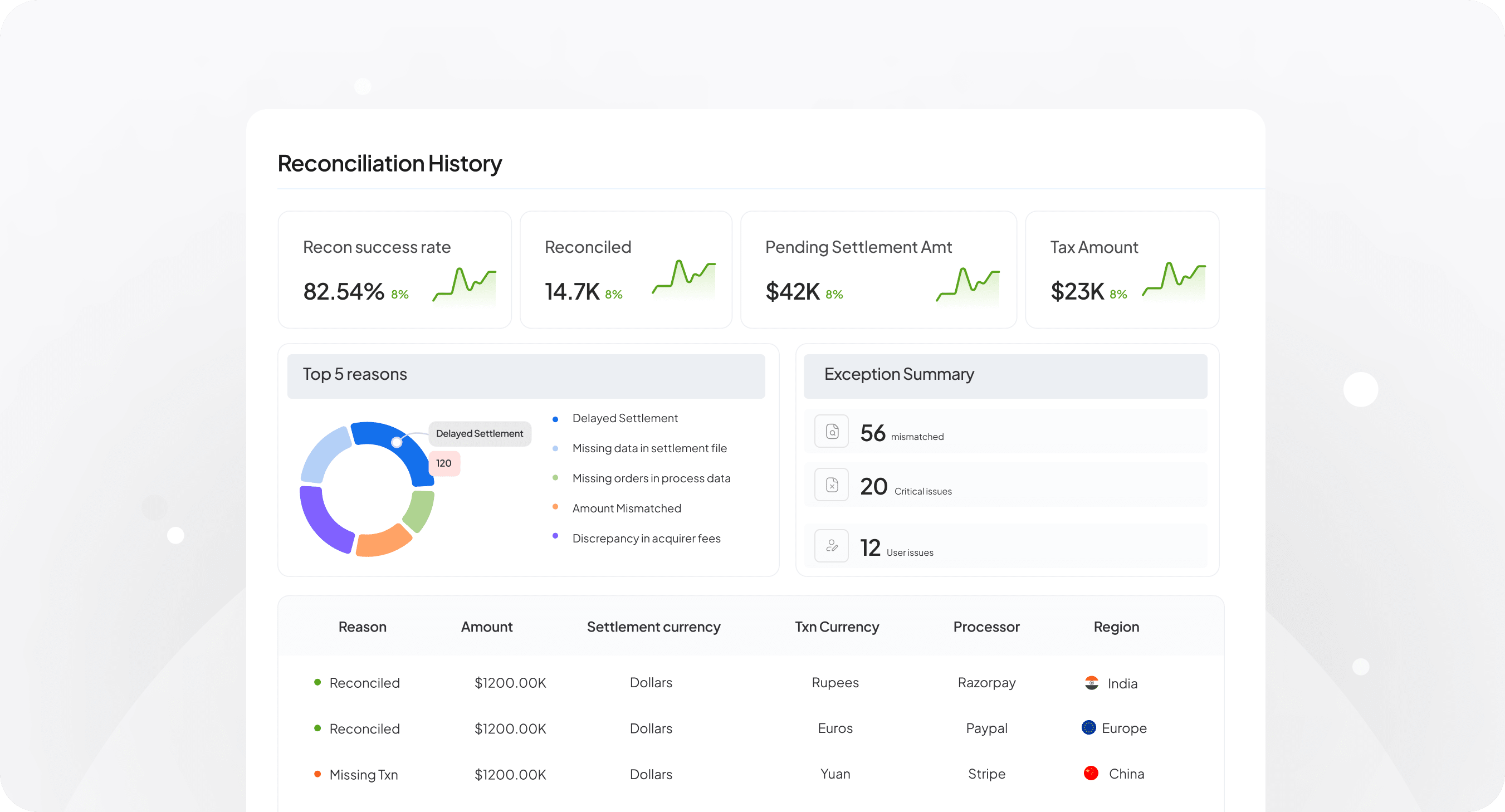

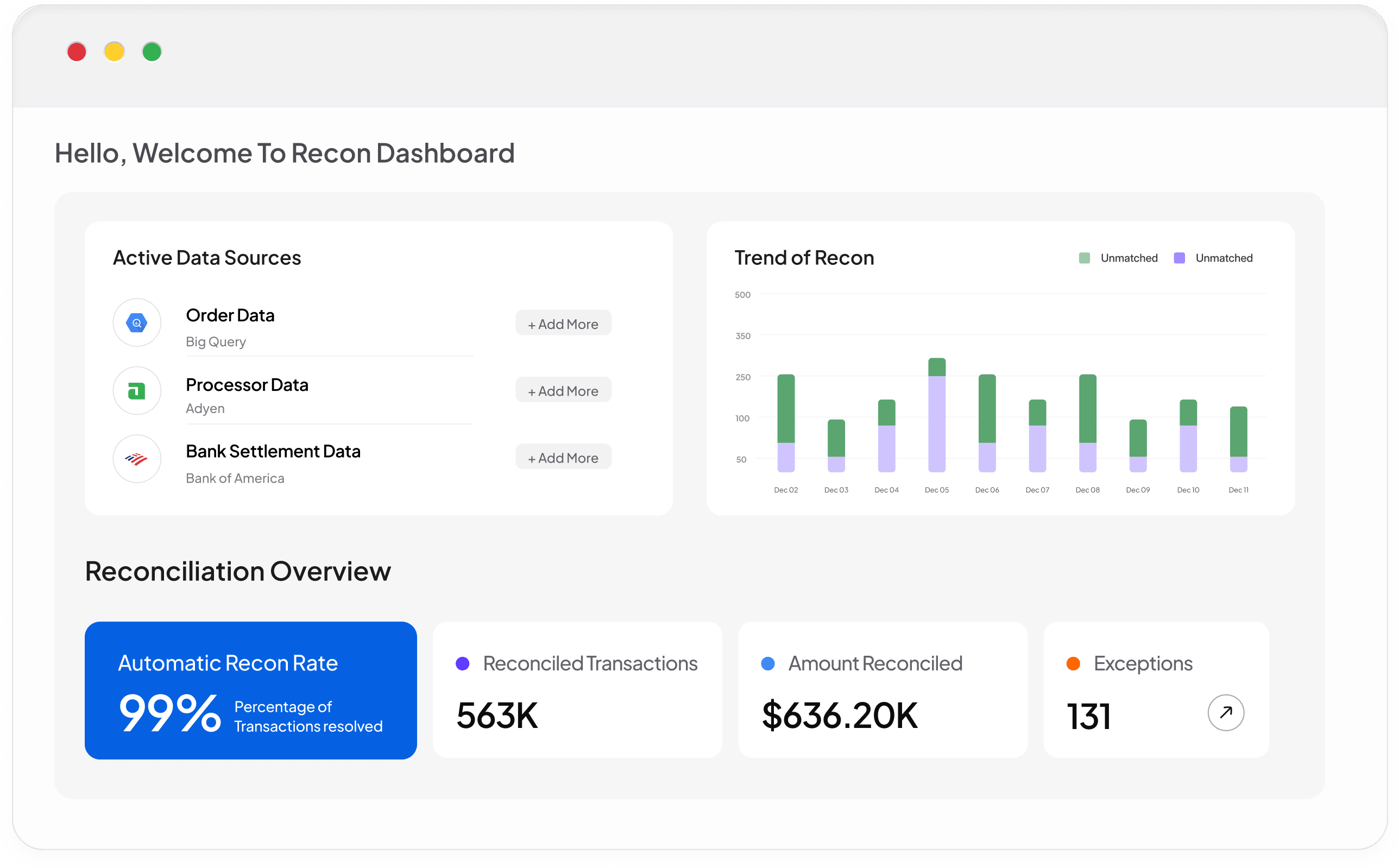

Real-time view of reconciliation patterns

Unified Reconciliation Dashboard powers a single source of truth for all reconciled, disputed and unknown transactions in one unified format. Get full visibility across PSPs, currency, FX, and transaction fees.

Granular error categorization for easy mismatch resolution

Resolve issues like processing fee mismatches or double charges effortlessly.

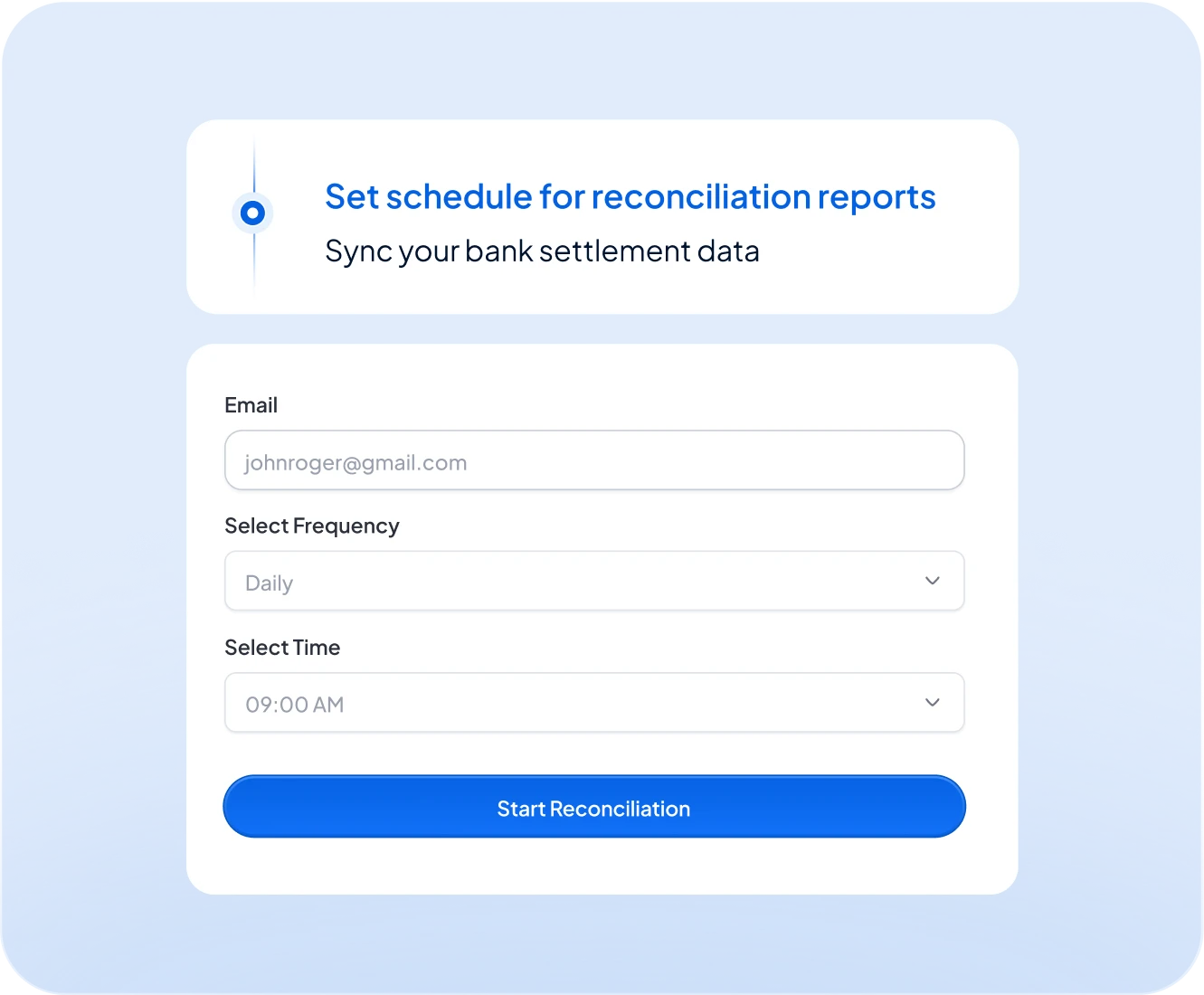

Automated

reconciliation workflows

Multi-region, multi-processor

reconciliation