Scaling Payments for

SaaS, Platforms, and Fintech

A unified modular payments layer that helps you scale and stay in control without vendor lock in

Trusted by the fastest growing businesses globally

Why your current payments setup

keeps slowing your growth

Why your current payments setup

keeps slowing your growth

Why your current payments setup keeps slowing your growth

How Hyperswitch helps platforms

break out of this loop

How Hyperswitch helps platforms break out of this loop

Onboarding slows when every customer needs custom setups and configs

Make onboarding repeatable across customer and merchant hierarchies

- Reuse configuration patterns for routing, payment methods, and credentials

- Scope changes per merchant without duplicating operational work

- Reduce setup time and support load as your platform scales

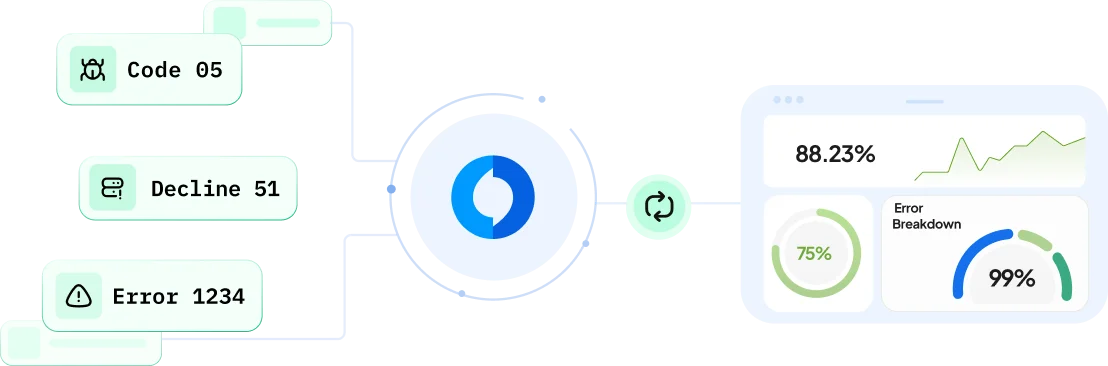

SLAs break when payment data is scattered across vendors

Get one view of the payment lifecycle so you can diagnose issues faster

- Trace transactions end to end across providers, steps, and retries

- Shorten time to root cause, reducing revenue impact and support burden

- Configure workflows and handling without waiting on one off fixes

Vendor lock-in limits reliability, cost control, and differentiation

Retain control as payments becomes a core part of your product

- Decouple your payment logic from any single provider or PSP roadmap

- Evolve your stack incrementally without disruptive migrations

- Own routing and reliability decisions as a platform differentiator

Explore payment use cases for your business type

Trust Engineered in Every Line of Code

OPEN SOURCE

GitHub

99.999%

Reliability

Traffic Spike

99.999%

Reliability

300 +

PSP / Acquirer Integrations

You can adopt Hyperswitch as your core payments infra or start with a single module that extends what you already have.

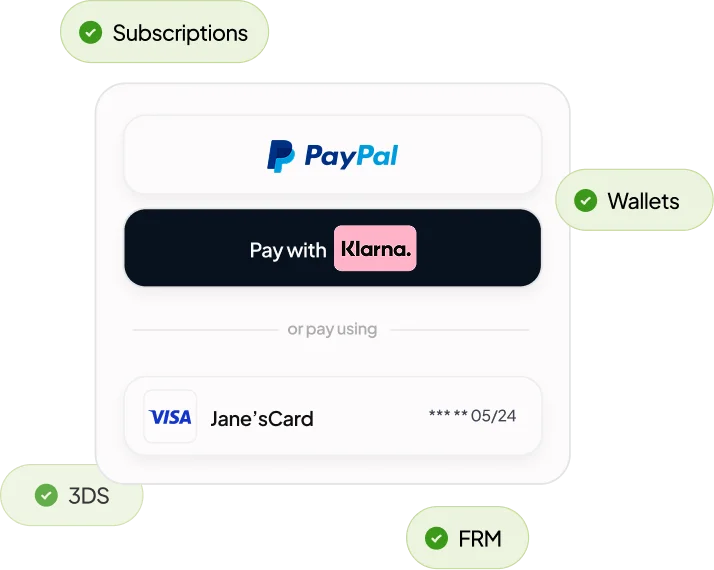

Connectors and orchestration core

One API in front of multiple PSPs, payment methods and payment tools. Route traffic, handle retries and plug in new providers without rewriting client-facing flows.

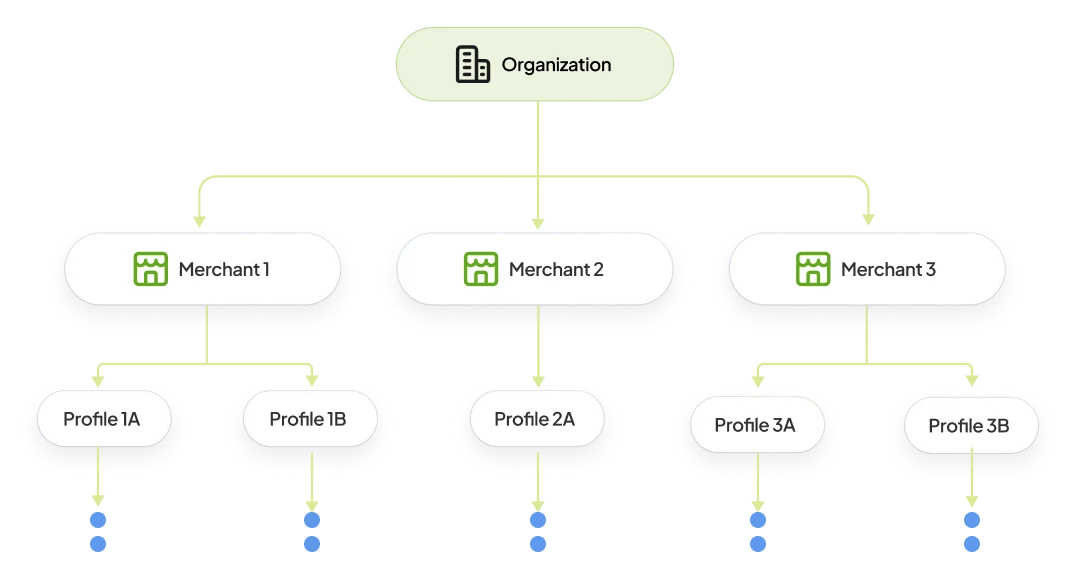

Organisation, merchant and profile model

Model your platform, your clients and their payment configurations with clear tenant isolation and a single operational view for your teams.

Platform accounts and embedded onboarding

Create and manage merchants programmatically, configure PSPs on their behalf and embed secure key/config collection flows in your own dashboard so onboarding feels native to your product.

Vaulting

Store and tokenize payment details in a dedicated vault. Support unified, external or PSP vaults, and optionally scope vaults per client when their industry or compliance requirements demand it.

Recon and reporting

Ingest and normalize provider data into a single events model, reconcile it with your internal records and payouts, and expose clear timelines and reports for support, finance and ops.

Ready to treat payments as

part of your infrastructure?

If you recognize these patterns in your own stack, you're already operating at a level where payments behave like core infrastructure. Hyperswitch gives you a modular way to take control: start with a single module alongside your existing setup, or work with us to design a path towards a full orchestration and reconciliation layer.