"Have no single point of failure. Have no single path to success."

- James Clear, Author of Atomic Habits

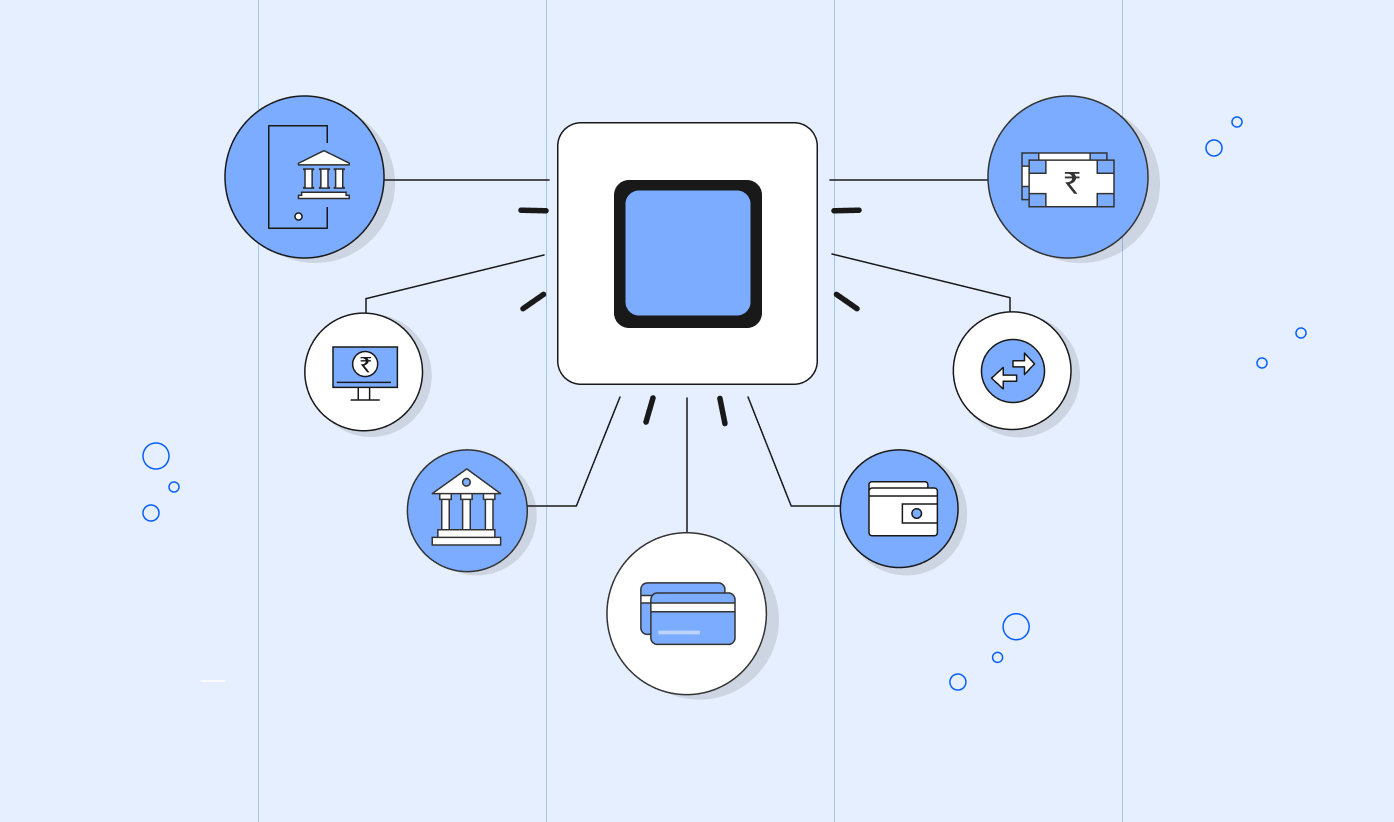

Is two better than one? Absolutely! Many businesses are adopting a multi-processor strategy for payments. A report by CyberSource says that US businesses use an avg of 4.1 payment partners (gateways, processors, etc.), and Europe businesses use an avg of 3.7 payment partners. This is a strong validation for the multi-processor strategy. It has multiple benefits apart from improving payment reliability. Here are the top 6 reasons why you should have multiple payment processors.

Your Payments CANNOT have downtime!

It takes time, effort, and money to acquire customers. Making them buy your offering is even more challenging. You don't want to lose revenue or customers because of broken payments. But failure is inevitable. It happens all the time in payments. The question is how we deal with it. Let's first understand why payments fail. They typically fail for three reasons:

- Your payment processor is down or unstable

- The payment method (the issuing bank or financial institution) is down or unstable

- Payment Authorization fails

While #3 happens for valid reasons like unavailability of funds or failed authentication (Eg. wrong password), genuine payment requests fail too. However, in all the 3 cases, you can recover the payment by retrying or rerouting the payment using your fallback payment processor. So, make sure to have a failover processor!

You get Freedom and Flexibility

Having a single processor means getting locked in. Payment Vendor lock-in is detrimental to your business in the long term. With multiple processors, you gain more control over your payments (read more ).

- Freedom & flexibility enables innovation.

- It makes your business agile and resilient to changes.

- It gives immense business flexibility on expansion.

- It allows customization of payment experience for your users (Eg. based on product, market, customer cohorts, etc.). You are not at the merch of a single processor for the UX!

Add New Payment Methods

According to PYMNTS, 52% of US consumers tried new payment methods in 2022, and the diversity of payment options will continue to grow. But not all payment processors support all relevant payment methods for your users. For example, Paypal as a payment method is not available in Stripe. In addition, global processors don't have good support for alternate payment methods (aka Local payment methods). So, the best way to keep up with the pace of innovation is to be inclusive and add more payment processors to support diversity.

Improve Payment Conversions

This single reason should justify why you should move to multiple processors. Both theoretically and practically, the conversion rates of 2 processors combined are better than a single processor. Having multiple processors helps to improve conversion rates by :

- Optimal mapping of payment method to processors

- Optimizing Payment Flow

- Auto-Retries

- Offering New Payment Methods

Reduce Payment Processing Fees

This is an excellent reason to add multiple processors if you are in high-volume, low-margin businesses like retail, financial services, travel, etc. Adding more processors can reduce your processing fees by smartly routing the transactions of a particular payment method through its lower-cost processor. Additionally, it gives you immense bargaining power to renegotiate the commercials and contract terms with your existing payment processor (read more ).

Future-proof your business

Last but not least, having multiple processors enables fast go-to-market. By onboarding a new payment processor, you can expand to new markets and offer new currencies or local payment methods. In addition, with multiple processors, you will own your customers' payment data using a neutral private vault solution instead of relying on the processor's vault. Also, the overall business continuity improves with multiple processors.

So, what is the catch?

You might think, "Hmm.. If having multiple processors has so many benefits, what is the catch?". First, it needs the effort to onboard, integrate, reconcile and maintain multiple processors, which could take precious dev efforts if you do it in-house. Alternatively, you can try Hyperswitch (a free, open-source, high-performance payment router to connect to multiple payment processors with a single integration and zero ongoing maintenance).

Key Takeaways

Most growing and established businesses have onboarded multiple processors. It helps businesses to:

- Improve payment reliability

- Gain freedom and flexibility

- Support diverse payment methods

- Improve conversion rate

- Reduce processing costs

- Future-proof the business

You can use Hyperswitch to get all these benefits without additional dev effort.