Payments should be affordable, like Oxygen.

Payments to any business are like what Oxygen is to our bodies. It is the invisible force that keeps everything running. Like many businesses, you may be paying hefty fees to process payments which ends up eating away at your profits. But like Oxygen, payments can be relatively inexpensive. Clever planning and diligent execution can reduce your payment costs by 10-50%.

Why reduce your Payment processing costs?

Startups and SMEs start their businesses with an easy-to-onboard payment processor, which typically charges a blended fee. For example, you pay between 3-5% of your revenue as processing fees (To learn more about the costs of payment processing, please read our blog). It is a simple, flat-fee model, but the final cost is high.

When you have reached product-market-fit, you should pay attention to the payment processing costs so that you can:

1. Improve your profitability

2. Increase sales by offering competitive prices to your customers.

Can you have cake and eat it too?

Many CXOs have the wrong notion that reducing payment processing costs comes at the expense of lower conversion rates or higher payment ops. On the contrary, you can reduce the costs without impacting conversion rates or payment ops. All it takes is having the right tools to optimize cost, conversion rate, and ops. So yes, you can have the cake and eat it too. The rest of the blog elaborates on how you can do this.

Framework for reducing your payment costs

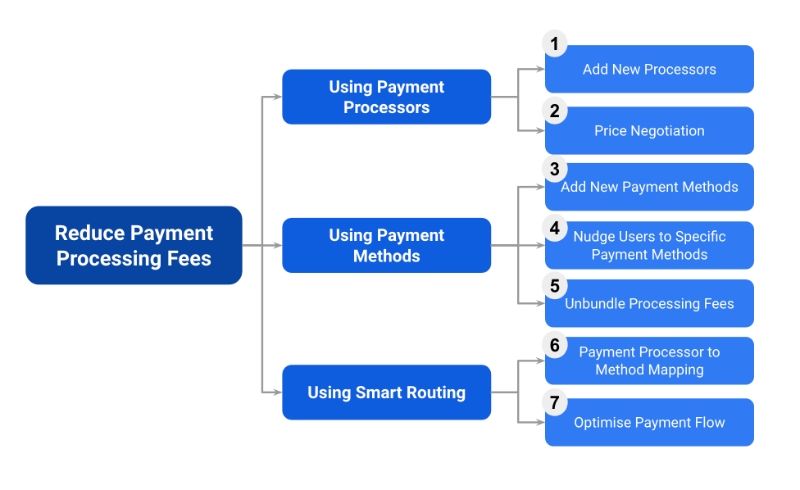

There are seven methods to optimize and reduce your payment costs. They fall into three buckets:

- A. Using Payment Processors: Under this category, we will use either a multi-processor strategy or price negotiation to reduce costs. The goal is to reduce the cost of existing processors or get new processors with lower costs.

- B. Using Payment Methods: Your total payment cost is a weighted average cost of various payment methods. The idea here is to increase the share of lower-cost payment methods.

- C. Using Smart Routing: This achieves payment efficiency by smartly routing the payments to a combination of processor and payment method

Methods for reducing payment processing cost

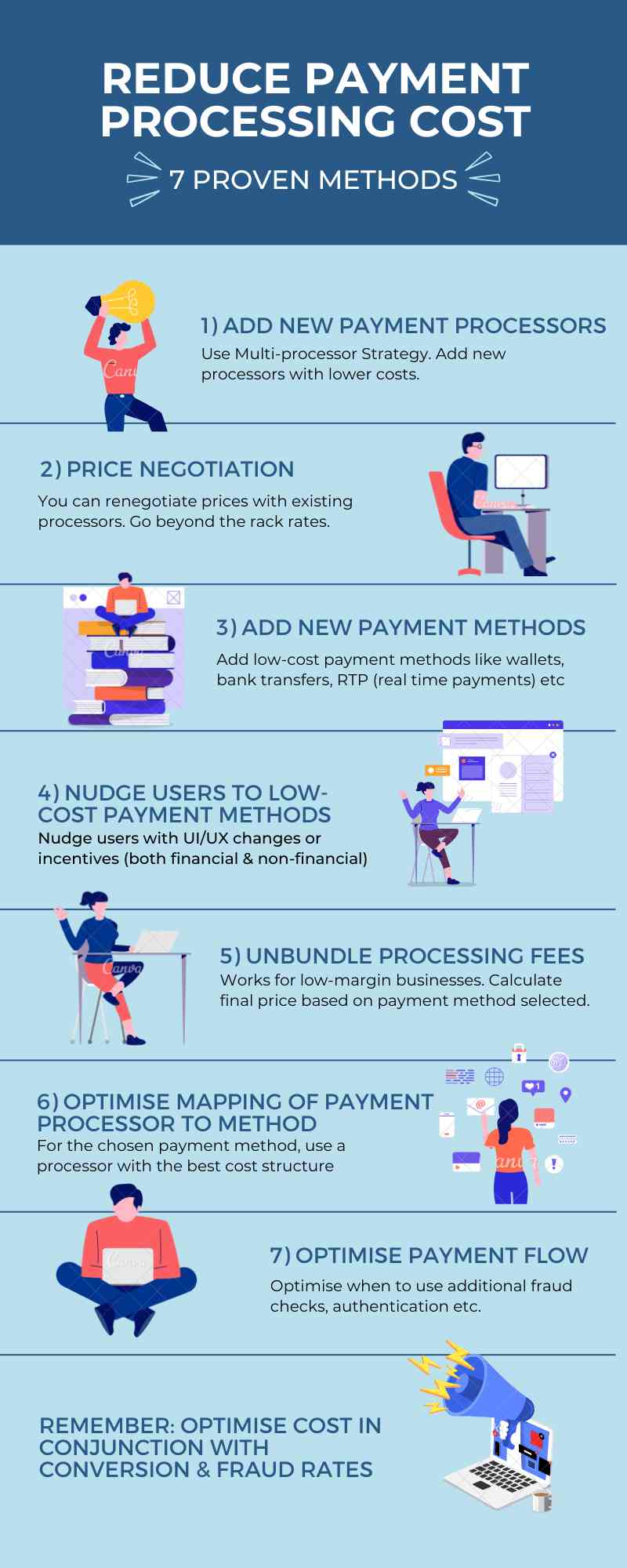

Method 1: Add New Payment Processors

Globally, there are an estimated 1000+ payment processors. Many of them have a presence across multiple countries/markets. Most mature e-commerce markets like the US and UK have 100+ payment processors. Not all processors may satisfy your business requirements. Still, there are enough options. Processors typically fall into four broad categories:

1. Payment Facilitators (Eg. Stripe, Braintree, etc.) - They are fast to onboard, but the price is not competitive, and features are not customizable

2. Global Acquiring processors (Eg. Worldpay, FirstData, etc.) - Reliable players and have good coverage across global markets, but take effort to onboard and limited support for low payment volumes.

3. Local Acquiring processors (Eg. Moneris, Credit Agricole, etc.) - Limited global coverage and is challenging to integrate, but gives you competitive rates.

4. Payment Gateways / Aggregators (Eg. CyberSource, ACI, etc.) - Good coverage and flexibility across markets, but it takes time to onboard or customize.

You should ask and evaluate processors based on these five criteria:

1. Payment Processing Fees (Is it better or on par with the existing processor?)

2. Overall coverage (Eg. payment methods supported, countries/currencies supported, etc.)

3. Features & use cases (Eg. PCI compliance, 3DS2 support, etc.)

4. Reliability & Performance (Eg. Uptime, Latency, etc.)

5. Overall Support (Eg. SLA, 24x7 support, Customisations, etc.)

You can read our detailed guide on selecting payment processors here.

Method 2: Price Negotiation

Many processors communicate only the standard fees. You could negotiate for a better price.

- Many processors insist that fees are non-negotiable, esp. if your payment volumes are low. Your best chance is to have more bargaining power by having at least two processors.

- Some processors agree to slab-based pricing, which is typically better than standard pricing. Here, your goal should be to keep the slab threshold minimal.

- Price negotiation is not a one-time activity but should be done regularly. For example, renegotiate it when payment volumes grow or there are new payment processors in the market.

Method 3: Add New Payment Methods

Gone are the days when businesses offered Cards as the only payment option. New payment methods like RTP (Real-time payments), wallets, A2A (Account to Account transfers), and many local payment methods are typically less expensive than cards. Adding new payment methods also increases your conversion rates.

- Local payment methods (LPM) are payment methods specific to a particular country. They have a good reach and low costs. Consider adding at least the top 2-3 LPMs for each market which is important to your business.

- Wallets typically have high conversion rates and smooth UX; costs could be competitive too.

- RTP and A2A payments have instant settlement and low fraud rates. If your business has high fraud rates, consider adding these methods.

- Evaluate new Payment methods holistically based on conversion rates, reach, and costs.

Method 4: Nudge Users to Specific Payment Methods

Once a variety of payment methods are made available, you can nudge users to opt for low-cost payment methods. Again, think win-win for your business and customers.

- For example, the checkout page can show the preferred payment methods (Eg. high conversion rates or low costs) at the top.

- At the top, show the saved payment methods (Eg. linked wallets, saved cards, etc.) with the better cost structure.

- Pass on the benefits of low-cost payment methods to users as benefits: financial (Eg. discounts, cashback) or non-financial (Eg. priority delivery, loyalty points).

Method 5: Unbundle Processing Fees

Adopt this method if your business has a wafer-thin margin like reselling, distribution, or financial services.

- The final cost of the service or shipment is dynamically calculated based on the payment method selected.

- You can add a separate "payment processing fee" line item in the billing.

- This kind of transparent pricing allows users to choose a cost-effective payment method.

Method 6: Payment Processor to Method Mapping

Once you have optimized the costs at the payment processor and method level, look at the combination to optimize the costs further.

- Create a grid of payment fees for Payment methods Vs. Payment processors. You will uncover efficient options.

- For each payment method, have a rank order list of processors. Make sure to pay attention to conversion rates. Always balance cost & conversion rates.

- Use a smart router to automatically choose the best payment processor for the chosen payment method.

Method 7: Optimise Payment Flow

The payment flow will impact cost, fraud rate, conversion rate, and user experience. Key questions to ask:

- What is the primary metric to optimize? What are the secondary metrics?

- When to send the transaction through additional fraud checks?

- When to apply higher-level security (Eg. 2-factor authentication)?

- When to show or disable saved payment methods?

Optimizing payment flow is best done using automation tools that allow you to write custom routing logic.

Payment Orchestrators like HyperSwitch makes it easy to worldpay using its multi-processor orchestrator and Smart Routing features.

Key Takeaways

- Payments should be affordable, and you can continuously reduce the costs without affecting other business metrics.

- Reduce costs by adding new processors and through negotiations with existing processors.

- Reduce costs by adding new payment methods, nudging users to low-cost payment methods, and unbundling the processing fees.

- Use Smart Routing to optimize (a) the mapping of payment methods to processors and (b) the overall payment flow.