Your business may have cracked the product market fit and started on the growth journey. Typically this is the stage where companies discover the direct impact of low conversion rates and make it one of their topmost priorities.

Improving payment conversion rates is not a one-time activity but a journey. And here are a few integral aspects to consider to keep ensuring that your payment conversion rates are on an improvement trend your payment conversion rates.

I. Choice of the Payment processor

Many businesses evaluate payment processors from the standpoint of cost, quick and developer-friendly integration, payment methods, compliance, and many more product and business aspects.

However, evaluating the payment processor from five aspects is essential to ensure that your conversion rates are the best in the market.

Holding a local payment license

Many global payment processors still need a local payment processing license in your market of interest. If that's not the case, card networks and issuer banks label all such transactions as cross-border, resulting in higher risk and lower conversion rates. So do enquire with your payment processor about the availability of a local license for each market.

Ability to handle your peak payment volume

The payment processor should have the technology infrastructure to process your peak sales (quantified as Transactions per second or Requests per second). Minor recurring glitches during your peak sale hours could cause a big dent in your payment conversion rates.

Minimal API latencies

Higher the API latencies of a transaction processor, the poorer the conversion rate. This aspect becomes crucial when you rely upon a single processor for accepting payment from a global audience.

Appropriate risk appetite for your nature of business

Based on the nature of your business, indicated by the Merchant Category Code (MCC), a payment processor would underwrite your risk of payment acceptance. Some payment processors naturally possess the risk appetite to support payments for high-risk merchants (such as gaming and digital goods). In contrast, some payment processors are optimal for low-risk merchants (such as physical goods and bill payments). So, enquire about your payment partner's clientele before your signup with them.

Speedy access to all the latest payment innovations in the market

Some payment processors are very agile and invest significant effort to launch the latest features to optimize customers' payment conversion rates. It could include the latest features like one-click payments, device-based authentication flows, and network tokenization, giving you more scope to enhance conversion rates. So, always enquire about the payment partner's time-to-market performance for new features.

II. Eliminate dependency on a single payment processor

While a payment partner is critical for your business, the reverse is rarely true. That entirely depends on the scale of your payments volume with the payment processor.

Hence, it is a best practice to rely on more than one payment processor, which could help your business with:

- Potential improvement of payment conversions rates

- Receiving competitive rates from the processors

- Ensuring a failure-resilient payment system

III. Payments Intelligence

Most payment processors generally do not provide transparency and deep analytics on how they internally route payments among their numerous acquirer integrations.

A typical payment processor's objective would be to optimize for their bottom line by routing across multiple acquirers, which could impact your business's conversion rates.

- Availability of the underlying acquirer

- Routing capabilities of the payment processor

- Quality of integration with the underlying acquirer

Your business would need payments intelligence leveraged in the form of various aspects.

Auto retry

When the payment fails with one processor due to fraud declines, or downtime, always retry with the next available alternative processor. The retry shall be attempted based on the reason for payment declines.

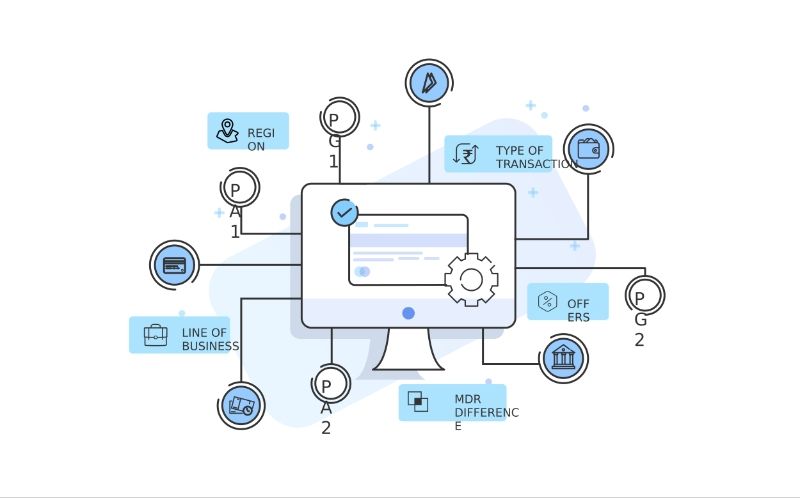

Dynamic Payments Routing

Based on historical performance and real-time performance of payment processors, the optimal real-time selection of payment processors can maximize the change of payment conversion.

Rule based Payments Routing

One of the most trusted ways of improving payment processing is using historical data. Especially when you process payments across multiple processors, it is crucial to stay on top of the questions (like) below and keep tweaking the smart routing rules regularly.

- Which payment method performs best or poorly across each payment processor?

- Which Card ISIN has the maximum conversation rate across each payment processor?

IV. Improve the quality of Fraud Prediction

There is a possibility that your fraud prediction engines are too conservative, resulting in many false positives and hence turning down genuine customers.

Control on Fraud Management

It is recommended to have granular control on the Fraud Management Engine to customize the fraud rules based on your business requirements. If your payment processor offers such fine control for Fraud Management, fully utilize it to specify rules to detect genuine customers better.

The other option is to go for an independent Fraud and Risk solution, which could help to reduce false positives and improve overall conversions.

Reducing network or bank declines with additional payment information

The card network and banks could have conservative mechanisms to filter fraudulent transactions, which could block many genuine customers too. However, collecting and submitting additional information on the shopping cart, billing details, and zip code can help mitigate false positives and increase the chances of conversion.

V. Enhancing Usability

Last but not least. The usability of the payment experience is crucial for improving conversion rates.

User-friendly error messaging

Payment processors provide API errors that could be developer-friendly but not necessarily user-friendly. Common failure reasons such as “You have entered an Invalid CVV” and “Insufficient funds in account” are often not communicated clearly to the user, resulting in repeated failed payment attempts.

In addition to the above problem, there is a wide diversity of how different payment partners communicate such failure reasons, and you need to implement a unified error system.

Highlighting user errors

Customers may prefer to correct their payment information while entering payment details. The best practice is to verify the payment details before initiating payment and communicating the user errors upfront. The more visibility to the user in minimizing the chance for mistakes, the better the payment conversion rates.

Alternative payment methods are not easily accessible to users

Upon repeated payment failures using the same payment method, nudging the user to pay with alternate payment methods increases the chances of conversion. In addition, payment methods such as ApplePay and GooglePay generally experience lower network declines due to additional biometric or password authentication layers.

In the case of your loyal customers, you can suggest previously used payment options of the customer.

Transparency on availability of payment methods

Due to systemic issues or planned maintenance activities, the conversion rates could fluctuate across payment methods. Hence, in the checkout experience, it is essential to communicate the downtimes of the chosen payment method to help customers make an informed decision. And such transparency in the availability of payment methods could help tweak user choice for the best conversion rates.

So, using a payment switch to manage your payments will help you with all the above aspects and improve conversion rates.

Hyperswitch is a high-performance payment switch embracing diversity and innovation to improve user experience and conversions while reducing the cost and operations for merchants. It is free and open to use.