A Payment processor is mandatory for businesses that accept cards. It manages the logistics of accepting credit and debit card payments from customers or other companies. They move the card data from the front end (card reader, web checkout page, smartphone PoS) to the financial institutions participating in the transaction. They ensure that the customer has enough funds or a line of credit to proceed with the transaction. They also ensure that the customer's sensitive information is safeguarded per the standards.

With so many payment processors, finding the right one may seem challenging. Primarily, a processor that's right for your business goals, fulfills your business needs, and is cost-effective. Braintree (a Paypal service) and Stripe are two processors that will feature in your consideration list. Knowing their features, similarities, and differences will help you categorize every other processor into the right bucket and make an informed decision.

Before we begin a quick primer on the Difference Between PayPal and Braintree?

Braintree is a subsidiary company of Paypal. It focuses entirely on payment gateways, payment processing, and merchant accounts for businesses. In contrast, Paypal focuses a lot on the peer-to-peer transfer of funds or private customers in general.

Like Stripe, you can install Braintrees's payment gateway directly on your website. As a result, users need not be redirected to Paypal's site to complete their checkout.

Braintree (a Paypal service) vs. Stripe summary

1.) Recommended for

- Braintree - Small and medium organizations looking for a dedicated merchant account owing to either high sales volumes or the risky nature of business (high chargebacks) or companies that need Paypal and Venmo in their checkout.

- Stripe - Small and medium organizations which are comfortable with integrations and APIs and are looking for flexibility

2.) Merchant account

- Braintree - Dedicated merchant account

- Stripe - Aggregates funds into a single merchant account

3.) Monthly fees

- Braintree - $0

- Stripe - The standard version of Stripe Connect has no platform fees, but a custom version starts at $2 per month per account.

4.) Transaction fees

- Braintree - 2.59% plus $0.49 per transaction for cards and wallets

- Stripe - 2.9% plus $0.30 per transaction for most online payments.

5.) Getting started

- Braintree - Merchants can start using Braintree immediately after filling out our signup form

- Stripe - It is much quicker to signup up to Stripe using - a name, email, and password since they provide an aggregated merchant account

Based on your core business objectives, let's understand which processor would be better and why.

Affordability

- Braintree

- Online card transactions - 49¢ + 2.59%

- Offline card transactions - 49¢ + 2.59% (for US, for American Express: 3.5%)

- ACH transactions - 0.75% ($5 cap)

- Chargeback fee - $15

- Wallets (Apple Pay, Alipay, and others) - 49¢ + 2.59%

- Stripe

- Online card transactions - 30¢ + 2.9% in US

- Offline card transactions - 5¢ + 2.7% to 30¢ + 2.9% for touchless

- ACH transactions - 0.8% ($5 cap)

- Chargeback fee - Stripe charges a $15 dispute fee for all chargebacks, but if the merchant wins the dispute, Stripe will refund the fee and the disputed amount.

- Wallets - 30¢ + 2.9% in the US

If you are still scaling, the cost difference between Braintree and Stripe will be manageable. However, as you scale, the difference in pricing will become prominent. Let's illustrate this with an example:

- Hundred online card transactions worth $100 each via Braintree will cost ~$12 cheaper than Stripe to process

- Hundred wallet transactions worth $100 each via Braintree will be $1.5 more affordable than Stripe to process

- So, overall on a $20,000 and 200 transactions business, Braintree would be $24 cheaper than Stripe in terms of processing costs.

However, one needs to look beyond just pricing and into the features and flexibilities offered by each processor before taking the call.

Easy to use

- Braintree

- Onboarding support - Support is provided to set up the account.

- Quick to onboard - Some merchants can start using Braintree immediately after filling out our signup form; in other cases, they'll need to gather some additional information by getting in touch within one business day.

- Frozen account - Much lower than Stripe

- Customer support - 24*7 support available with a form-based support system

- Stripe

- Onboarding support - Account onboarding is done; training happens in person.

- Quick to onboard - Onboarding happens in minutes with basic details.

- Frozen account - Higher than Adyen

- Customer support - 24*7 support

In ease-of-use, Stripe excels in terms of speed of access, setting up an account, resources available, support articles, video tutorials, and a stripe-certified developer community for app building or integration.

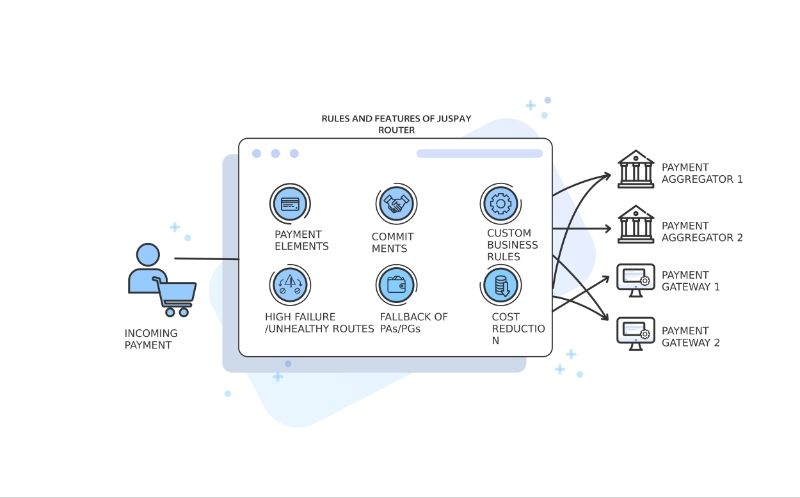

However, in the 'Affordability' section, we observed the cost difference between the two processors. Hence, the question to the business teams is - do you give up savings because it is complex to integrate with Braintree? Payment orchestrators exist primarily to solve such scenarios.

An orchestrator allows you to get the benefits of both processors with a single integration.

Richness in payment types for online transactions

- Braintree

- Payment types supported - cards, wallets, contactless payments, ACH debit, and credit

- Cards supported - Visa, Mastercard, American Express, Discover, Unionpay

- Wallets - Apple pay, Google pay, Secure remote commerce, Samsung pay, Paypal, and Venmo

- Payment methods not supported - many cards and wallets are not supported

- Stripe

- Payment types supported - cards, wallets, bank debits & transfers, bank redirects, BNPL, cash-based vouchers

- Cards supported - Visa, Mastercard, American Express, Diners, Discover, Interac, Cartes Banciares, JCB, China union pay

- Wallets - Apple pay, Google pay, Secure remote commerce, Link, Mobile pay, Ali pay, Wechat pay, Grab pay

- Payment methods not supported - Paypal, Samsung pay

Braintree has the advantage of accepting PayPal and Venmo payments, two of the most popular digital payment options in the US, and can boost conversion rates. However, Stripe's pre-built integrations, broad international reach, and ability to accept local currencies must be considered when deciding which processor to adopt.

A payment orchestrator simplifies this decision for you. It allows you to integrate these processors (and more) with a single integration and benefit from the best features available.

Additional business features

- Braintree

- PoS solutions - Provides a custom-built solution with integrations (PayPal Zettle).

- Risk management - Provides advanced fraud protection with machine learning and customizable risk levels.

- Analytics - Provides key transaction insights with control panel reports and advanced transaction searches.

- Payouts - 2 business days—4 weeks, depending on the bank

- Stripe

- PoS solution - Provides a single type of PoS solution called the Stripe terminal. It unifies online and in-store payments with features like customer management.

- Risk management - Provide a 'Radar' solution that detects and blocks fraud using machine learning that trains on data across millions of global companies. The charges for this solution are separate per transaction.

- Analytics - Provides a 'Sigma' solution that allows you to use predefined SQL queries or write new custom queries inside the Stripe dashboard. The charges for this solution are separate based on transaction volumes (tiered pricing) transactions.

- Payouts - 2 days. There is an instant payout option of 1% of payout volume plus a min fee of 30¢.

International processing

- Braintree

- Currencies supported - 130+

- Merchant countries - 45

- Languages supported - 20+

- Internation processing fees - 1%

- Currency conversion charges - 1%

- Stripe

- Currencies supported - 137

- Merchant countries - 47

- Languages supported - 30+

- Cross-border fees - 1.5%

- Currency conversion charges - 1%

The processor selection here would depend on the availability of payment methods and language support in the countries you are present or want to expand. The pricing aspect plays a role only if both processors are on the same footing.

The role of an orchestrator becomes critical in this case. For example, if your business is eyeing international markets, you would want your expansion strategy independent of your processor capabilities. An orchestrator allows you to integrate with as many processors as possible and continue your expansion unhindered.

Business needs

- Braintree

- Pre-built payment page - You can start accepting payments immediately through their drop-in UI.

- Customizable payments UI - It allows you to tailor your checkout flow while remaining compliant with PCI SAQ A through payment APIs for the app or web.

- Integrations - Fewer integrations with eCommerce, social media, online stores, apps, online sales funnels, and more

- Payment in installments - Paypal pay later offers short-term interest-free payments and long-term monthly installments.

- Subscriptions - It accepts online repeat payments for software, subscription-based businesses, donations, and more.

- Invoicing - Via third party

- Stripe

- Pre-built payment page - It is called "Checkout." It is a pre-built, hosted payment page optimized for conversion.

- Customizable payments UI - it is called "Elements." It allows you to design a secure payment experience using rick UI building blocks

- Integrations - 650+ integrations, including online stores, email marketing, sales funnels, crowdfunding, and more

- Payment in installments - Klarna

- Subscriptions - Provides support to recurring billing models with smart retries and automated reporting.

- Invoicing - Simple and recurring

To sum it up, Stripe offers more online sales functions than Braintree and a more significant number of integrations. Stripe Terminal makes creating a custom checkout experience easy, making it an excellent choice for designing checkout carts. It has native invoicing and an online checkout page you can use as a virtual terminal. Stripe's pre-built integrations with popular eCommerce platforms make it an excellent choice for small online merchants. Stripe also has a broad international reach and a higher ability to accept local currencies, making it a good fit for large eCommerce companies.

Braintree, on the other hand, offers drop-in and custom user interface codes that make it easy to create a smooth and secure checkout experience. In addition, it provides a dedicated merchant account along with Paypal and Venmo in the checkout options.

Most businesses need to integrate with multiple processors to provide rich payment options and a great customer payment experience and to optimize costs. Orchestrators help serve this purpose seamlessly.