A hosted payment page is an externally hosted webpage that accepts online payments on behalf of the merchants. Instead of integrating a payment gateway / processor themselves, merchants can use a hosted payment page provided by a third party Payment Service Provider (PSP) and thereby reduce their overhead. A hosted payment page has its benefits and constraints. Depending on the business needs for flexibility, scalability and control, merchants choose between a hosted payment page and integrating a payment gateway.

How do my customers checkout on a hosted payment page?

A typical flow for the customer to pay on a hosted payment page is -

1. Customer selects items: When a customer decides to make a purchase on the merchant's website, they add items to their cart and proceed to checkout by clicking on Checkout/ Buy now or a similar button.

2. Customer is shown the payment page: The customer is shown the payment page either on the same website, as a pop-up or redirected to a separate url.

3. Payment details entry: On the Hosted Payment Page, the customer enters their payment information, such as credit card details or other payment methods, depending on the available options.

4. Processing payment: The payment service provider securely processes the payment using the provided payment details. The transaction is then communicated to the merchant and payment gateway for verification.

5. Order confirmation: The merchant confirms the order and displays the order confirmation page if the payment is successful. In case of a redirection flow, the customer is redirected to that page. In case of a failed transaction, the merchant may choose to reload the payment page to give one more chance to the customer to pay and place their order.

Why Should I go for a hosted payment page?

The checkout experience can either make or break the customers’ willingness to complete the transaction during the online transaction process. A good checkout experience translates to better conversion rates. A payment page has to provide a secure, seamless, and trusted payment experience. A hosted payment page can offer numerous benefits, some of the important ones are -

1. Simplified Integration: Most of the PSPs design the integration of a hosted payment system in favor of reducing integration complexity for the merchants. In absence of a hosted payment page, the merchants will not only have to handle the UI/ UX part of the payment flow, but also maintain a complex integration with processor(s). The complexity is increased multifold if the merchant wants to use multiple processors for offering more payment methods, better MDR, reliability, etc.

2. Security and compliance: In order to process card data, merchants need to be compliant with PCI DSS standards for security and to avoid severe financial penalties. The security burden on the merchant, including annual audits, and maintaining compliance can be a distraction from their business goals.

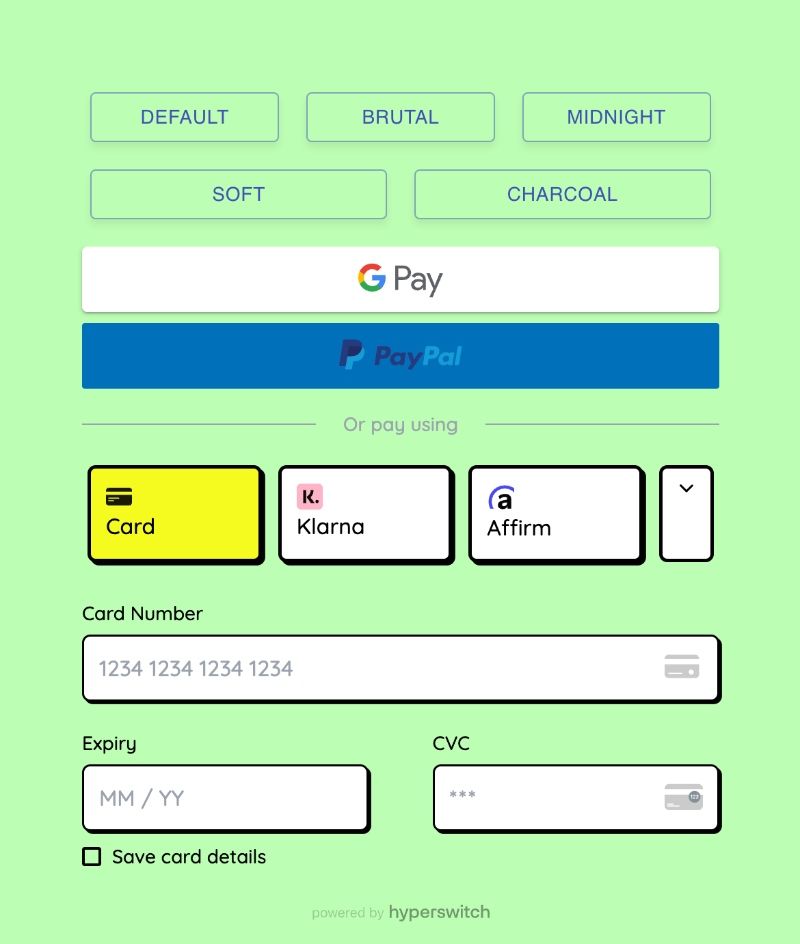

3. Seamless UI/ UX: Offering world-class UI and the most optimal UX for the customers is one of the most important factors to consider using a hosted checkout page. The seamless UX can directly contribute to a higher conversion rate for the merchant. Some hosted payment pages also support customization of UI that blends seamlessly with the merchants branding. The known look and feel of the payment page can help to build customer trust while making payments.

4. Ease of adding new payment methods: With a hosted payment page, adding a new payment method can be as easy as going on the PSP’s dashboard and enabling the payment method. With little to no change in the integration, merchants can offer new and local payment methods to their customers and expect better conversion rates.

How can I integrate a hosted payment page on my website?

A hosted payment page can be integrated on the merchant website in multiple ways -

1. iFrames - An iframe of the payment page is embedded on the merchant website. It can be a very seamless experience for the end-customers and they might not even notice a difference between the merchant website elements / components and a third party hosted payment page component (depending on the UI customizability of the hosted payment page).

2. Redirections - On clicking the Pay button, the customer is redirected to a separate url where the payment page is shown and the customer interacts with the payment page. They can choose to pay via the available payment options. Once the payment is done (whose status can be successful, failure or pending), the customer is redirected to the merchant website.

3. Pop-ups / Modal - On clicking the Pay button, a pop-up/ modal comes up on the screen and the payment page is displayed. The customer then completes the payment on that modal, after which it closes and the merchant website handles the next flow of the customer.

The iFrame might be a better experience for the customer compared to a redirection flow, but integrating that will be more complex than integrating a checkout button that redirects the user to the hosted payment page. In cases where the merchant does not want the customers to interact with other elements of the website during payment, and also do not want the users to experience a redirection, a modal can be preferred over iFrame. The business use case, tech bandwidth and preferred UX that the merchants want for their customers drives the choice between an iFrame vs redirection vs modal integration of the hosted payment page.

How should I decide on the PSP for my hosted payment page?

There are multiple considerations while choosing the right hosted payment page provider for your business. Ease of integration, availability of a card vault for saved cards, security and compliance, trust and familiarity of the customers, mobile optimizations and responsiveness to mobile screens, user experience, brand consistency support, multi-currency and multi-language support, etc., are important while considering a PSP.

How can I use multiple processors with my hosted payment page?

Apart from PSPs, many payment orchestrators also provide a hosted payment page. The payment orchestrator is a tech layer that connects the merchants on one side and numerous PSPs, acquirers, banks, payment methods, etc. on the other. The added benefits of an orchestrator include a unified checkout in the frontend, with ease of routing the transaction to more than one payment processor in the backend. Orchestrators like Hyperswitch also provide support for unified analytics and dashboard, support for subscriptions, surcharges based on payment methods, vault to save cards that belong to the merchant and not the processor, and many more.

How does a hosted payment page enhance security?

A hosted payment page enhances security through several key mechanisms:

- Data Isolation: With a hosted payment page, sensitive payment data is collected and processed on the secure servers of the payment service provider (PSP), preventing this data from ever entering the merchant's website. This isolation significantly reduces the risk of data breaches or unauthorized access.

- PCI DSS Compliance: Hosted payment pages are designed to adhere to the Payment Card Industry Data Security Standard (PCI DSS) requirements. By using a third-party provider that is PCI DSS compliant, businesses can ensure that their payment processes meet stringent security standards.

- Encryption: Hosted payment pages use encryption protocols such as SSL/TLS to encrypt the data transmitted between the customer's browser and the PSP's servers. This ensures that even if data is intercepted, it remains unreadable and protected.

- Tokenization: Tokenization is a technique where sensitive payment data is replaced with a unique token. This token is used for transactions, while the actual data is securely stored by the PSP. In case of a breach, only tokens are compromised, rendering the stolen data useless without the corresponding encryption keys.

- Regular Audits and Monitoring: Reputable hosted payment page providers undergo regular security audits and monitoring to identify vulnerabilities and maintain the highest security standards.

- Vendor Expertise: Payment service providers specialize in secure payment processing. By leveraging their expertise, businesses can benefit from their investments in security infrastructure, continuous monitoring, and response to emerging threats.

In essence, a hosted payment page enhances security by shifting the responsibility of handling payment data to experts who prioritize security. This approach reduces the risks associated with data breaches, fraud, and cyberattacks, providing both businesses and customers with peace of mind during online transactions.

Can I customize the appearance of my hosted payment page?

Yes, many hosted payment page providers offer the option to customize the appearance of the payment page to align with your brand's identity and create a seamless user experience. While the extent of customization can vary between providers, most common customization options are brand color, themes and layouts, design, fonts and typography, background colors, language support, etc.

In conclusion, hosted payment pages offer a strategic solution to streamline and enhance the online payment experience for both businesses and customers. By delegating the responsibility of handling sensitive payment information to trusted third-party providers, businesses can focus on their core operations without compromising security or user experience.

The user-friendly interface and mobile optimization of hosted payment pages contribute to a seamless and convenient checkout process, reducing cart abandonment rates and boosting conversion rates. This is particularly crucial in today's digital landscape, where online shoppers seek hassle-free and trustworthy transactions.