With so many payment processors, finding the right one may seem challenging. You need to find a processor that's right for your business, fulfills your needs, and is cost-effective. Adyen and Stripe are two processors that will feature in your consideration list. Knowing their features, similarities, and differences will help you categorize every other processor into the right bucket and make an informed decision.

Adyen and Stripe are both payment processors. A payment processor connects the merchant's bank and the issuing bank. Besides securing payment data and transmitting it to other parties, it also ensures that all transactions adhere to the Payment Card Industry Data Security Standard (PCI DSS) guidelines.

Adyen vs. Stripe summary

- Business size

- Adyen - Mid-sized and large organization looking for Omni-channel payment processing

- Stripe - Small and medium organizations which are comfortable with integrations and APIs and are looking for flexibility

- Merchant account

- Adyen - Dedicated merchant account

- Stripe - Aggregates funds into a single merchant account

- Minimum billing (per month)

- Adyen - $120

- Stripe - $0

- Transaction fees

- Adyen - Interchange-plus-based pricing (processing fee plus a payment method fee per transaction)

- Stripe - 2.9% plus $0.30 per transaction for most online payments for US merchants. Stripe's pricing varies by country and payment method.

- Getting started

- Adyen - You'll need to apply for a dedicated merchant account and go through the underwriting process, which takes time

- Stripe - It is much quicker to signup up to Stripe using - a name, email, and password since they use an aggregated merchant account

Based on your core business objectives, let's understand which processor would be better and why.

Affordability

- Adyen -

- Online card transactions - 12¢ + 2.6% to 22¢ + 3.3% in US

- Offline card transactions - 12¢ + 2.6% to 22¢ + 3.3% in US

- ACH transactions - 37¢

- Chargeback fee - up to 0.5% of the transaction

- Minimum monthly billing - $120

- Stripe -

- Online card transactions - 30¢ + 2.9% in US

- Offline card transactions - 5¢ + 2.7% to 30¢ + 2.9% for touchless

- ACH transactions - 0.8% ($5 cap)

- Chargeback fee - Stripe charges a $15 dispute fee for all chargebacks, but if the merchant wins the dispute, Stripe will refund the fee and the disputed amount.

- Minimum monthly billing - Doesn't exist.

If you are a more prominent merchant who can fulfill the minimum billing criteria, then Adyen will be cheaper with its' interchange plus pricing. However, if the bulk of your transactions come from offline stores via "card present" transactions, Stripe starts to look more affordable.

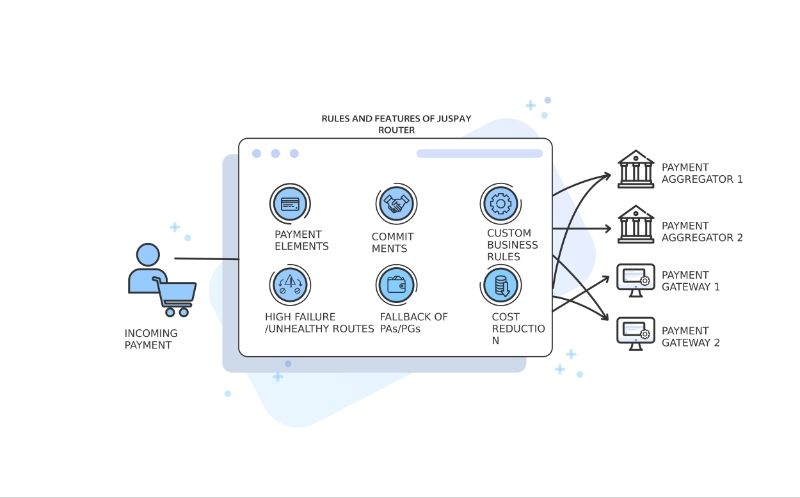

A payment orchestrator can connect with both processors and route transactions to them based on the transaction type, thereby allowing you to benefit from the lowest possible processing cost for every transaction.

Easy to use

- Adyen -

- Onboarding support - Account onboarding is done; training happens in-person

- Quick to onboard - Onboarding takes time since dedicated accounts require documentation and underwriting

- Frozen account - Lower than Stripe

- Customer support - Ticket-based support system

- Stripe -

- Onboarding support - Self/ automated; Stripe-certified developers (additional charge)

- Quick to onboard - Onboarding happens in minutes with basic details

- Frozen account - Higher than Adyen

- Customer support - 24*7 support

In ease-of-use, Stripe excels in terms of speed of access, setting up an account, resources available, support articles, video tutorials, and a stripe-certified developer community for app building or integration.

You will notice that each of these processors seems to have an edge over the other in certain spheres. Therefore, the answer to which processor to choose may be "both."

A payment orchestrator allows you to do just that. With a single integration, get the benefits of both processors.

Richness in payment types for online transactions

- Adyen

- Payment types supported - cards, wallets, contactless payments, ACH debit and credit, cash

- Cards supported - Visa, Mastercard, American Express, Diners, Discover, Interac, Cartes Banciares, JCB (+9 more)

- Wallets - Apple pay, Google pay, Mobile pay, Ali pay, Wechat pay, Grab pay, Amazon pay, Paypal, Samsung pay (+10 more)

- Payment methods not supported - Cheques

- Stripe

- Payment types supported - cards, wallets, bank debits & transfers, bank redirects, BNPL, cash-based vouchers

- Cards supported - Visa, Mastercard, American Express, Diners, Discover, Interac, Cartes Banciares, JCB, China union pay

- Wallets - Apple pay, Google pay, Secure remote commerce, Link, Mobile pay, Ali pay, Wechat pay, Grab pay

- Payment methods not supported - Paypal, Samsung pay

Both processors offer most payment options but miss out on a few, which may require a separate integration or an orchestrator to help integrate and intelligently route the transactions.

Additional business features

- Adyen -

- PoS solutions - Provides a wide range of PoS solutions like the countertop, mobile, portable, multimedia, and unattended to support a wide range of offline use cases.

- Risk management - Provides a robust risk management solution that allows business rules to be added to their algorithms to fulfill the goals.

- Analytics - Provides insights focussed on business growth, making it easier to find critical metrics like revenue generated by channel, payments made by payment methods, and more.

- Payouts - As per a programmed schedule or immediate (manual option)

- Stripe -

- PoS solution - Provides a single type of PoS solution called the Stripe terminal.

- Risk management - Provide a 'Radar' solution that detects and blocks fraud using machine learning that trains on data across millions of global companies. The charges for this solution are separate per transaction.

- Analytics - Provides a 'Sigma' solution that allows you to use predefined SQL queries or write new custom queries inside the Stripe dashboard. The charges for this solution are separate based on transaction volumes (tiered pricing) transactions.

- Payouts - 2 days. There is an instant payout option of 1% of payout volume plus a min fee of 30¢.

Adyen provides most of the features as a part of their package and therefore becomes a preferred choice.

International processing

- Adyen -

- Currencies supported - 130

- Merchant countries - 37

- Languages supported - 29

- Cross-border fee - unknown

- Currency conversion charges - 1.2% - 3%

- Stripe -

- Currencies supported - 137

- Merchant countries - 47

- Languages supported - 30+

- Cross-border fee - 30¢ + 1%

- Currency conversion charges - 1%

The processor selection here would depend on the availability of payment methods and language support in the countries you are present or want to expand. The pricing aspect plays a role only if both processors are on the same footing.

The role of an orchestrator becomes critical in this case. For example, if your business is eyeing international markets, you would want your expansion strategy independent of your processor capabilities. An orchestrator allows you to integrate with as many processors as possible and continue your expansion unhindered.

Business needs

- Adyen -

- Pre-built payment page - It is called "Drop-in." Quick to integrate but allows for less control over payments UI.

- Customizable payments UI - It is called "Components." These are pre-built payment forms for individual payment methods. You can use these to build a checkout.

- Integrations - 100+ integrations in eCommerce, PoS, mobile, unified commerce, CRM, and more

- Payment in installments - Klarna

- Subscriptions - Providing support for multiple recurring business models like streaming services, subscription boxes, memberships, and pay-as-you-go.

- Invoicing - Third-party integration

- Stripe -

- Pre-built payment page - It is called "Checkout." It is a pre-built, hosted payment page optimized for conversion.

- Customizable payments UI - it is called "Elements." It allows you to design a secure payment experience using rick UI building blocks

- Integrations - 650+ integrations, including online stores, email marketing, sales funnels, crowdfunding, and more

- Payment in installments - Klarna

- Subscriptions - Provides support to recurring billing models with smart retries and automated reporting.

- Invoicing - Simple and recurring

To sum it up, Adyen and Stripe are both great payment processors, but the choice between the two boils down to business needs, priorities, and capabilities. Most businesses need to integrate with multiple processors to provide rich payment options, a great payment experience, and to optimize costs. Orchestrators help serve this purpose seamlessly.

Want to know more about Hyperswitch?