Well, does having multiple processors provide any noticeable cost savings whatsoever for small / mid-sized businesses or is it all just a gimmick?

So, we decided to look at the public pricing of some of the leading US payment processors since these processors don’t bother giving custom pricing to small/mid-sized businesses anyway.

First thoughts: It’s maddeningly complex! There are so many damn variations even within the types of pricing offered:

- fixed fee per transaction

- variable or percentage based pricing

- Percentage + Absolute

- Percentage + Minimum

- maximum cap per transaction

- fixed fee per month

- Interchange fee and so on.

Adding to this complexity is the variety of parameters across which pricing varies:

- Payment methods

- Currency

- Customer

- Card issuing country

- Merchant category (MCC) in case of Interchange++, etc.

All this effort to just understand the pricing for basic payments processing use case without considering all other myriad of auxiliary costs such as failed payments, reversal/refunds, disputes, chargebacks, no code integration, billing, invoicing, etc!

Now, we need to break down this complexity

So, like a run-of-the mill Excel nerd, we decided to build a straightforward Excel calculator. Its purpose? To forecast and predict the processing costs across a few leading US processors to see if we could unearth any notable cost differentials that merchants could potentially capitalize on.

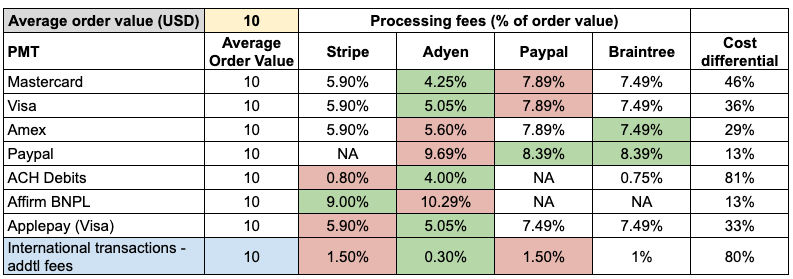

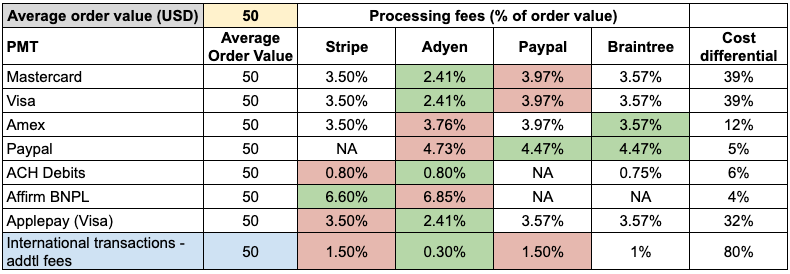

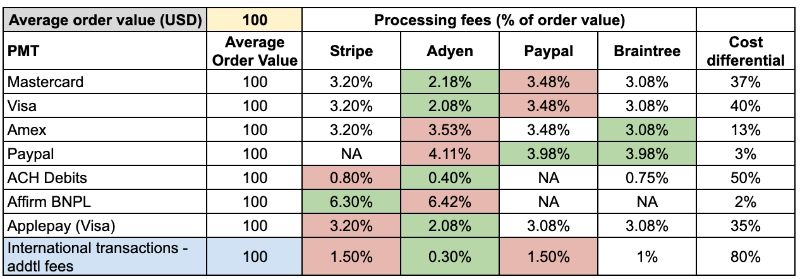

We considered the public pricing of four leading US processors - Stripe, Adyen, Paypal and Braintree and tried to simulate the processing fees as (% of order value) for various payment methods and different order values.

i) For an Average order value of USD 10:

ii) For an Average order value of USD 50:

iii) For an Average order value of USD 100:

Here is a link to the calculator and feel free to play around.

Key takeaways from the cost calculator

1. Not one processor is the cheapest or most expensive across all payment methods:

On a quick glance, you can straightaway see that the cheapest and the most expensive processors for each payment method varies and there isn’t a single processor that is the cheapest across all methods. This makes for an easy argument for the merchants to have multiple processors but let’s see if there are more.

2. All payment methods aren’t available through one processor except for Adyen

Another easy one to notice. ‘NA’ under the annual processing fees for each processor conveys that the corresponding payment method isn’t available for those processors. Adyen is the only processor that has all the payment methods while Stripe doesn’t have Paypal yet in the US probably due to Paypal viewing them as direct competition. So, any merchant looking to offer a variety of payment methods would have to end up using multiple processors.

3. Cost differential between the cheapest and costliest processors varies across payment methods:

While there is only a slight cost differential in cases of Amex and Affirm, a much more pronounced differential between 30-50% can be seen in cases of Mastercard, Visa, ACH debits. Since these are the most popular payment methods,thesel cost differential could prove vital while trying to optimize overall payment costs

4. Interchange++

- Domestic card transactions:

Adyen is cheaper for Mastercard and Visa because of its Interchange++ pricing when it comes to variable pricing for these methods - International card transactions:

Adyen is again significantly affordable for International Transactions due to Interchange++.

Thus, merchants can realize substantial savings if they have a lot of both domestic as well as international shoppers and process their payments through a Interchange+ pricing based processor like Adyen

5. Average order value affects the Payment Processing fees significantly for Card transactions and BNPL across all processors

Except for ACH Debits and International transactions where there is only a fixed fee per transaction, all other payment methods are expensive for processing low average order value across all processors since a variable % fee is levied in addition to the fixed fee.

6. Of course, Paypal is cheaper through Paypal and Braintree:

No secret revelations to see here. Straightforward for the merchants to offer Paypal through either of these processors.

Now, why do payment processing fees vary so much across different processors?

1. Diversity in Services

Payment processors are not a one-size-fits-all solution; they cater to a wide spectrum of businesses, each with unique needs and requirements. Some processors provide basic payment gateway services, while others offer an array of additional features such as fraud prevention, data analytics, and subscription management. As a result, the fee structure reflects the scope and sophistication of the services provided.

2. Technology Infrastructure

Payment processors invest heavily in building and maintaining the complex technology infrastructures that ensure security, speed, and reliability behind every payment and these infrastructures can vary greatly in terms of quality and capabilities. Processors with more advanced systems, robust cybersecurity measures and heavy R&D investments may justify higher fees by offering superior protection against data breaches and fraud and also providing cutting-edge features and customer experience.

3. Scale of Operations

Larger companies that process a high volume of transactions can spread their fixed costs over a larger base, enabling them to offer competitive rates. Smaller processors, on the other hand, may have higher operating costs per transaction and therefore need to charge more to cover their expenses and generate a reasonable profit.

4. Compliance and Regulatory Costs

Staying compliant with the various industry standards and regulations in the heavily regulated financial landscape involves substantial costs, including legal fees, audits, and security measures. Processors that invest in robust compliance frameworks often reflect these costs in their fee structures, ensuring that businesses can rely on their adherence to industry standards.

5. Customer Support and Experience

Processors that offer comprehensive and responsive customer support services, available around the clock, may incorporate the associated costs into their fees.

Thus, in the chaotic and tight-margins world of small/mid-sized businesses, there could be a largely under-tapped opportunity: optimizing payment processing costs through multi-processor setup.

While it's no secret that payment processing fees are an unavoidable part of the business landscape, what often remains hidden or rather obscure are the significant cost differentials that exist among various payment processors. Small businesses looking to offer diverse payment methods would definitely benefit from a multiple processor setup given the substantial cost differentials of up to 40% among different payment methods and an overall reduction of up to 25%.

From established giants to emerging fintech players, each processor employs its own fee structures and pricing models, making it crucial for businesses to understand the intricate pricing details before making a choice to move to a multi-processor setup from a single-processor.

Now, before you leave you might wanna know: “How does custom pricing affect all this?”

While we have examined the publicly available default pricing offered by these processors to small to mid-sized businesses, it is worth noting that merchants with higher transaction volumes have the opportunity to negotiate custom pricing. This can involve volume or value slab-based pricing arrangements with certain processors.

Well, despite being a small business, if you’ve managed to secure custom pricing with these processors with public pricing, we bow down to you!

When custom pricing based on volume/value slabs is involved, optimizing overall payment costs across multiple processors introduces additional complexities:

- The selection of the most cost-effective processor for a specific payment method becomes dynamic and individual transaction-dependent, influenced by the volume calculations.

- Forecasting and historical trends analysis would have to be considered if we are to optimize these costs dynamically based on volume/value slabs

So, tracking transaction volumes and dynamically selecting the processors during each transaction is definitely not something every small/mid-sized business could be equipped to carry out.

Maybe, more on this in another article soon!