Importance of a payment method

A payment method is how the customer pays for a product or service. It has a significant influence on

- Final purchase decisions of consumers

- The ticket size of the purchase

- Convenience and ease of payment

"According to the Mckinsey digital payment survey 2021, of the respondents who used BNPL, 29 percent report that they would have made a smaller purchase or not purchased without this financing option."

"Studies show that shoppers using credit cards for shopping are willing to spend more on items, check out with bigger baskets, and focus on and remember more product benefits rather than costs."

82% of Americans use digital payments. A view of the market share of different payment methods in the US is shared below (Source: Statista report on most popular e-commerce payment methods in the US 2016-2021):

- Credit cards - 30%

- E-wallet/ Digital/ mobile wallets - 30%

- Debit cards - 21%

- Bank transfer - 8%

- BNPL - 4%

- Others (Prepay, CoD, prepaid card, Direct debit) - 7%

List of the popular payment methods in the US

Credit & Debit cards

These are the most popular payment method and a must-have for every merchant.

Key credit card networks include Visa, Mastercard, American Express, and Discover. They extend credit to the customers to make the purchase and settle with the merchant. The customers pay their card balance monthly. Visa and MasterCard are networks that back cards issued by banks, and each sets its rates. American Express and Discover act as both networks and banks and issue interchange rates.

When a customer uses a credit card, the merchant is charged an interchange fee by the networks for processing credit and debit card transactions. The interchange fee is passed to the bank that issued the customer's credit card (Issuer). Factors affecting the interchange fee are :

- The card network that the card belongs to

- Type of card - credit vs. debit card

- Type of sale - card present vs. card not present sale

- Type of card program - reward card, cashback card, corporate purchase card, and others

The average credit card interchange rates for the primary card networks are:

- Visa: 1.4% to 2.5%

- MasterCard: 1.5% to 2.6%

- American Express: 2.3% to 3.5%

- Discover: 1.55% to 2.5%

All of them charge 0.05% for debit cards.

Most payment service providers or processors will support all major networks for card transactions.

E-wallet/ Digital/ mobile wallets:

E-wallets allow consumers to pay quickly for online transactions without the need to enter card details again and are more secure than traditional online payment methods. As a result, the E-wallet category is predicted to grow in market share from 30% to 41% by 2024 in the US. Globally, their penetration will reach 75% by 2025.

In addition to being the customer's favorite, they offer a host of advantages to the merchants as well:

- It helps accelerate checkout and reduce cart abandonment.

- It helps reduce fraud and increase conversion on mobile.

- They also help businesses reach each Asian buyers, where wallets are the most popular payment method.

- Offer rewards and personalization, helping improve engagement.

However, some wallets don't support subscriptions; therefore, the proper selection also depends on your business model.

Key wallet providers in the US are - Paypal, Venmo, Apple pay, Google pay, and Amazon pay. As per Statista's consumer survey to understand the usage of digital wallets by US consumers, the share of different wallets in the US consumer base is as follows :

- Paypal accounted for 37%

- Venmo 15%

- At the same time, Google pay, Apple pay, and Amazon pay each share a 12% market share.

The processing fee against the popular wallets are as follows:

- Paypal - 2.9% + $0.49

- Venmo - 1.9% + $0.10

- Apple pay - 2.6% + $0.10

- Google pay - 1.9% + $0.30

- Amazon pay - 2.9% + $0.30

Implementation guidelines for digital wallets:

- Offer wallet options that match the customer's device. Prioritize Apple pay vs. Google pay vs. Samsung pay based on the type of device

- Don't rely on a single wallet provider but have a bouquet of the most popular options presented aesthetically.

Buy Now Pay Later (BNPL)

Buy Now Pay Later is a form of credit that allows a consumer to split a retail transaction into smaller, interest-free installments and repay over time. As a result, BNPLs have been growing in popularity. Not only has their popularity been increasing, but also they contribute to incremental sales at checkout.

According to the Mckinsey digital payment report 2021, BNPL’s impact on incremental sales varies significantly across verticals. The highest cumulative conversion rates happen in discretionary categories - apparel, laptops, and beauty products. Up to 20% of respondents from the discretionary categories say that the purchases would not have occurred without BNPL. Conversely, incremental conversion is far lower (3% to 5%) in less

impulsive categories, such as tires and auto parts, home appliances, and home improvement.

The top 3 items purchased with BNPL are - electronics (44%), clothing & fashion (37%), and furniture or appliances (33%). These results signify that businesses in the discretionary segments must take advantage of BNPLs.

BNPL services come in two types :

Invoicing - Shoppers checkout with no money paid and owe the total amount in 14-30 days. This is a zero-interest option and is most prevalent in Europe.

Installments - Shoppers pay the balance in bi-weekly or monthly payments. With some BNPL payment methods, a deposit is collected at the time of purchase.* This is most popular in North America.

The most popular BNPL providers in the US and their processing fees:

- Affirm - $0.30 + 6% (Stripe); $0.12 + direct contract with Affirm (Adyen)

- Afterpay - $0.30 + 6% (Stripe); $0.42 + 4.9% (Adyen)

- Klarna - $0.30 + 5.9% (Stripe); $0.42 + 4.3% (Adyen)

To summarize, if you're a business in the US and are selling to US consumers following are the payment methods you need to support:

- Cards

- Visa, Mastercard, American Express, and Discover.

- Wallets

- Paypal, Apple pay, Google pay

- BNPL

- Affirm, Afterpay

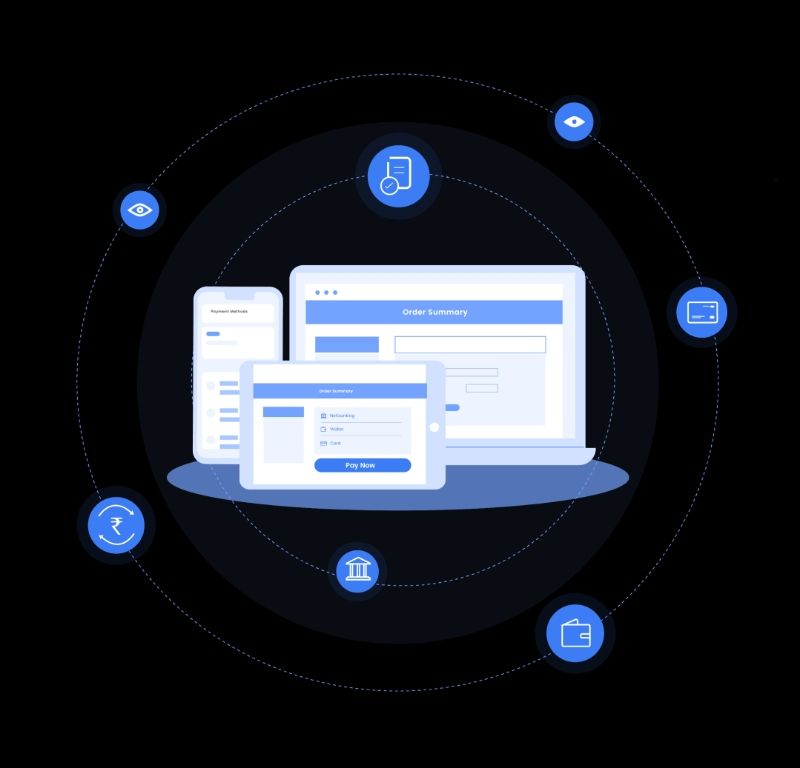

Businesses would require a payment orchestrator to support the payment methods mentioned above. Let's understand what a payment orchestrator is and its functionalities:

- A payment orchestrator is connected to multiple processors, service providers, and gateways on one side and the business on the other.

- The business needs to integrate only with the payment orchestrator to gain access to the different processors connected with it.

- A payment orchestrator simplifies things for the business:

- Processors only support some of the payment methods that a business needs. E.g., Stripe doesn't support Paypal and Samsung pay. With an orchestrator, you can easily tap into all the processors and payment methods with a single integration.

- The payment processing charges differ across different processors, even for the same payment method. With an orchestrator, you can route transactions smartly to other processors based on cost as the business goal.