Whether you're a small online store or a multinational corporation, understanding payment processors is essential for smooth financial operations. In this blog post, we'll dive deep into the world of payment processors, clarifying their definition, explaining how they work, and outlining their significance in modern business. We'll also help you choose the right payment processor for your business and explore the various benefits they bring. So, let's get started!

Differentiating Payment Gateway and Payment Processor:

Before we delve into the world of payment processors, it's important to differentiate them from payment gateways. While both are integral to online transactions, they serve distinct roles. Payment gateways facilitate the secure transfer of payment data between the customer, merchant, and the payment processor. On the other hand, payment processors handle the actual transaction, authorizing and processing the payment. Think of payment gateways as the bridge, and payment processors as the engine that powers the payment journey.

What is a Payment Processor?

A payment processor is a financial institution or a third-party service provider that manages electronic transactions between a customer's bank and the merchant's bank. In simpler terms, it acts as an intermediary that enables the movement of funds from the customer to the merchant when a purchase is made. Payment processors ensure that these transactions are secure, accurate, and swift.

Fact: The first payment card was created in 1950 by Ralph Schneider and Frank McNamara to allow members to use charge cards at their Diners' Club, and consumers were required to pay their bill in full each month.

How Does a Payment Processor Work?

Understanding how payment processors work is essential for comprehending their role in modern commerce. Here's a breakdown:

- Authorization: When a customer initiates a payment, the payment processor checks the validity of the transaction. It verifies the customer's payment details, ensures the funds are available, and confirms that the transaction meets security requirements.

- Processing: Once the transaction is authorized, the payment processor processes it. This involves transferring funds from the customer's bank account to the merchant's account. It also records the transaction for future reference.

- Settlement: After processing, the payment processor settles the funds. This typically involves batching multiple transactions and transferring the total amount to the merchant's bank account within a specified time frame, often on a daily basis.

- Reporting: Payment processors generate detailed reports of transactions for both merchants and customers. These reports help track and reconcile payments, providing transparency and accountability.

What is the Role of a Payment Processor?

Payment processors play several critical roles in the world of digital payments:

- Transaction Security: They ensure that payments are made securely by employing encryption and fraud detection measures.

- Currency Conversion: In international transactions, payment processors can handle currency conversion, making it easier for merchants to accept payments from customers worldwide.

- Customer Support: They offer customer support to handle payment-related issues, chargebacks, and disputes.

- Compliance: Payment processors ensure that transactions comply with industry regulations and legal requirements, reducing the risk of financial penalties for merchants.

How to Choose a Payment Processor for Your Business?

Selecting the right payment processor for your business can significantly impact your success. Here are some factors to consider:

- Compatibility: Ensure that the payment processor integrates seamlessly with your existing software and platforms.

- Costs: Evaluate processing fees, setup fees, and any additional charges to understand the true cost of using a particular payment processor.

- Security: Prioritize payment processors with robust security features to protect your customers' data.

- Global Reach: If you plan to expand internationally, choose a payment processor with support for multiple currencies and payment methods.

How Payment Processors Can Benefit Your Business:

Payment processors offer numerous advantages to businesses of all sizes:

- Increased Sales: They provide customers with convenient payment options, reducing cart abandonment rates and boosting sales.

- Enhanced Security: Payment processors implement rigorous security measures, reducing the risk of fraud and data breaches.

- Streamlined Operations: Automated processing and reporting save time and effort for both merchants and customers.

- Global Expansion: Payment processors enable businesses to reach a global audience by accepting payments from around the world.

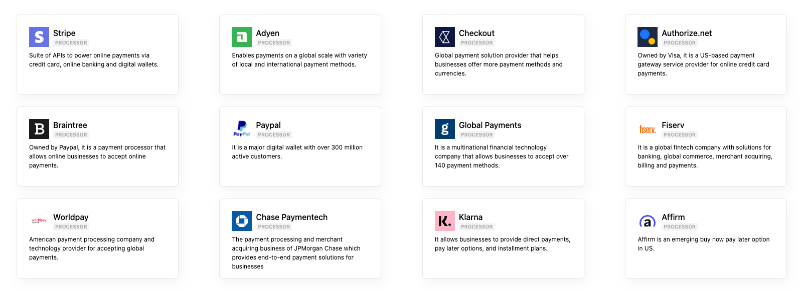

Examples of Payment Processors:

There are various payment processors available, catering to different business needs. Here are a few examples:

- Stripe: Known for its flexibility and developer-friendly tools, Stripe is popular among startups and e-commerce businesses.

- PayPal: Widely recognized and trusted, PayPal offers a range of solutions for businesses of all sizes.

- Square: Ideal for small businesses and local retailers, Square provides user-friendly point-of-sale and online payment processing.

- Authorize.Net: Authorize.Net is a long-established payment processor known for its robust security features and reliability.

FAQs:

To wrap up our discussion on payment processors, let's address some frequently asked questions:

- What does a payment processor do?

A payment processor facilitates electronic transactions by authorizing and processing payments, ensuring the secure movement of funds between customers and merchants. - Can I use multiple payment processors for my business?

Yes, you can use multiple payment processors to provide customers with diverse payment options, but it's essential to manage them efficiently to avoid complications. - Is UPI a payment processor? No, UPI (Unified Payments Interface) is not a payment processor but rather a real-time payment system used in India. Payment processors can utilize UPI as one of their payment methods.

In conclusion, payment processors are the backbone of modern commerce, enabling businesses to accept electronic payments securely and efficiently. Understanding their role, choosing the right one for your business, and harnessing their benefits can significantly contribute to your success in the digital marketplace. So, whether you're a seasoned entrepreneur or just starting, make informed decisions about your payment processing needs, to thrive in the ever-evolving world of e-commerce.