Offering seamless payments is a must-have for online businesses in the post-pandemic world. Customers expect seamless payment experiences and the ability to pay through a variety of payment methods, which is a driving factor in the purchase choice. So what important objectives should your business prioritize to make the payments more seamless for customers while being more cost-effective and efficient for your business?

Enhance the reliability of your payment infrastructure

Dependency on a single payment processor can significantly impact your business if the processor experiences downtime. And if the payment processor has not planned for handling your peak payment volumes, it could severely impact your business.

Hyperswitch is a lightweight payment switch that can help you migrate quickly to a multi-processor setup and enjoy 100% reliability for your payments stack. It ensures that your payments are routed to the processor based on availability and automatically retries if any failure is encountered.

Align payments to your business goals

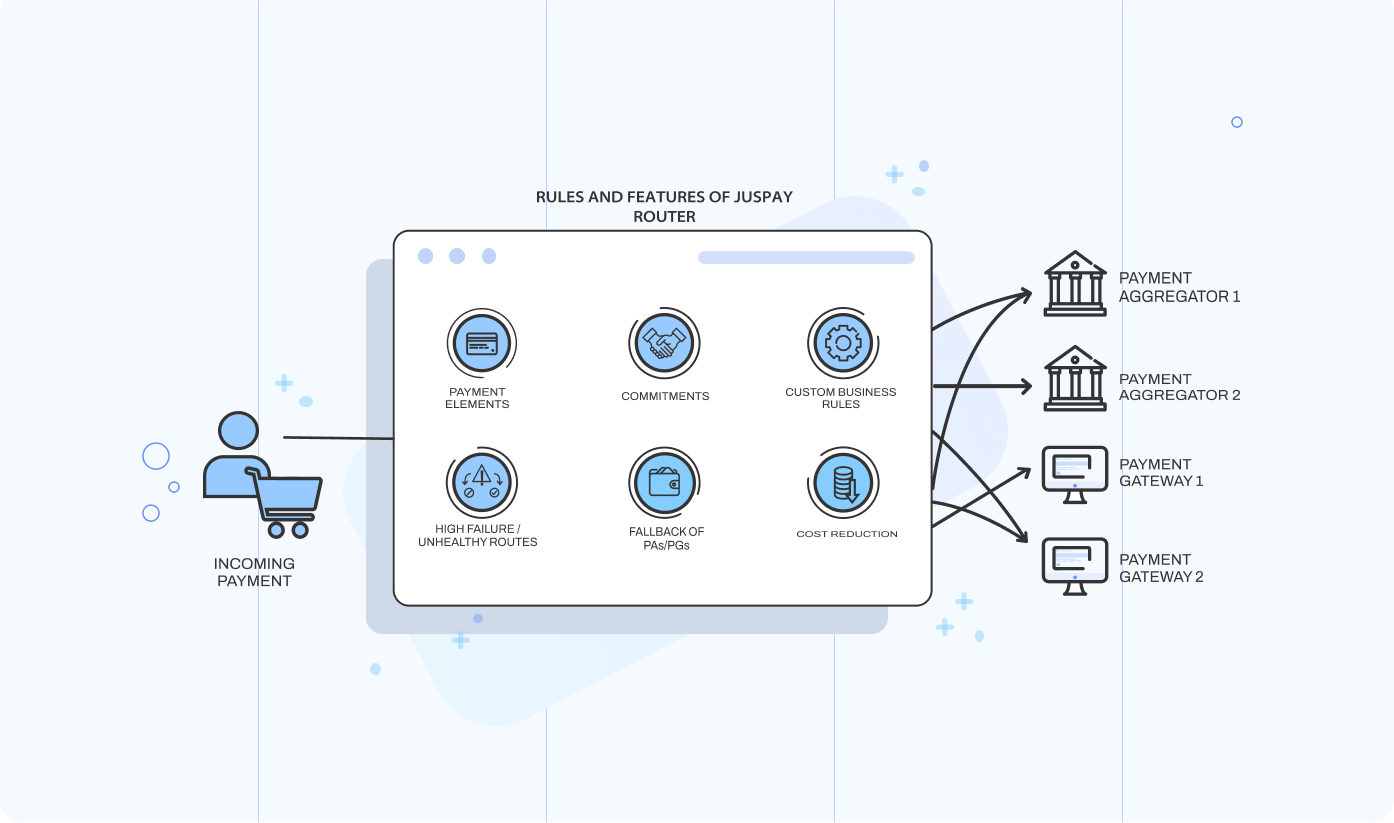

Your business goals might demand you to leverage multiple payment processors to (i) improve conversion rates, (ii) reduce costs, (iii) reduce fraud (iv) mix of all the above.

And channeling payments across multiple processors could be challenging to manage daily because your business needs would constantly evolve, or another new payment processor might provide you with competitive pricing, and so on.

Hyperswitch's Smart Router is designed as a no-code tool to provide complete control and transparency upon creating and modifying the smart routing rules. So you can easily align payments with your business goals.

Quick go-to-market for new payment integrations

As your business grows faster, there will be a need to expand payment offerings with more payment processors. This need might arise due to multiple reasons:

- Launching a business in new geography with a local payment processor, or

- Offering local payment methods for your customers, or

- Offering new payment methods for your customers, or

- Optimizing payment processing costs with an additional processor, or

- Reducing dependency on a single processor

Integrating and maintaining multiple payment processors is a complex activity and could drain significant tech bandwidth from your core business activities. In addition, as your business reaches scale, it would require a dedicated technology and payments team at great expense.

Hyperswitch is pre-integrated with 400+ payment processors, and adding a new payment processor is fully automated. Hence, you can add new payment processors without development effort. And you get access to all the latest payment innovations in the market through a single interface.

Enhance the payment experience for your customers

Improving conversation rates on your checkout and providing a delightful payment experience should be an important agenda for your business.

Hyperswitch Unified Checkout provides an inclusive, consistent and blended payment experience optimized for the best conversion rates. It encompasses

- Globally inclusive and consistent payment experience with the ability to adapt to local preferences and language customization

- Smart payment forms with input validation, autofocus, autofill, masking, and error feedback to reduce friction for the user

- Wide range of styling APIs to tweak the appearance to blend with your app or website

- Early access to all the latest payment methods, with zero to very minimal tech investment

- Cross-platform support for Web, Android, iOS, and React Native

Optimize payment processing costs

Your organization's teams responsible for Customer Experience, Finance, and Business Growth might be spending a lot of time and effort managing payment operations.

What is payment operations?

Payment Operations refers to the operation time, and effort businesses spend beyond the payment processing step to manage the entire lifecycle of payments. Adequate attention to payment operations might positively impact your Net Promoter Score (NPS) and enhance the growth of your business.

Below are some day-to-day use cases of payments operations that could extract significant bandwidth from focusing on your core business growth.

| Customer Experience Team | Finance Team | Business ops. & growth |

| Issuing refunds to customers | Reconciliation of Payment Processed versus Amount Settled to Bank | Tracking, analyzing, and enhancing payment authorization rate |

| Proactive monitoring of failed refunds and delayed refunds | Timely submission of evidence for chargeback claims from the customer | Expanding to new markets and accepting new payment methods |

| Customer queries on double debits | Reducing the cost of fraud by modifying | Product Returns versus Refunds issued to the customer |

| Customer queries on incomplete/ delayed payments | Optimizing payment processing cost with Smart Routing | Reporting across multiple business units/ product lines |

| Reporting across multiple business units/ product lines | ||

| Triggering bulk refunds |

Hyperswitch Control Center is a single interface that all your teams will be required to use for all Payment Operations use cases. Hence more power to your team for managing payments seamlessly. In addition to the above, it also includes rich features to make operations more automated for your teams, such as

- Real-time analytics

- Checkout analytics

- Automated Reports

- Alerts automation

- Managing user roles and access

Wish to know more?

Visit our website to know more