Security is paramount with payments. You may have heard of 3D Secure payment, but what exactly is it, and how does it work to safeguard your online transactions? In this blog post, we'll dive deep into the world of 3D Secure payment, unraveling its intricacies and shedding light on its importance. We'll explore how it operates, its advantages and disadvantages, the key differences between 3D Secure and 3D Secure 2.0, and why your business needs a 3D Secure payment gateway. So, fasten your seatbelts as we embark on this journey to demystify 3D Secure payments and ensure you have a secure online shopping experience.

What is 3D Secure Payment?

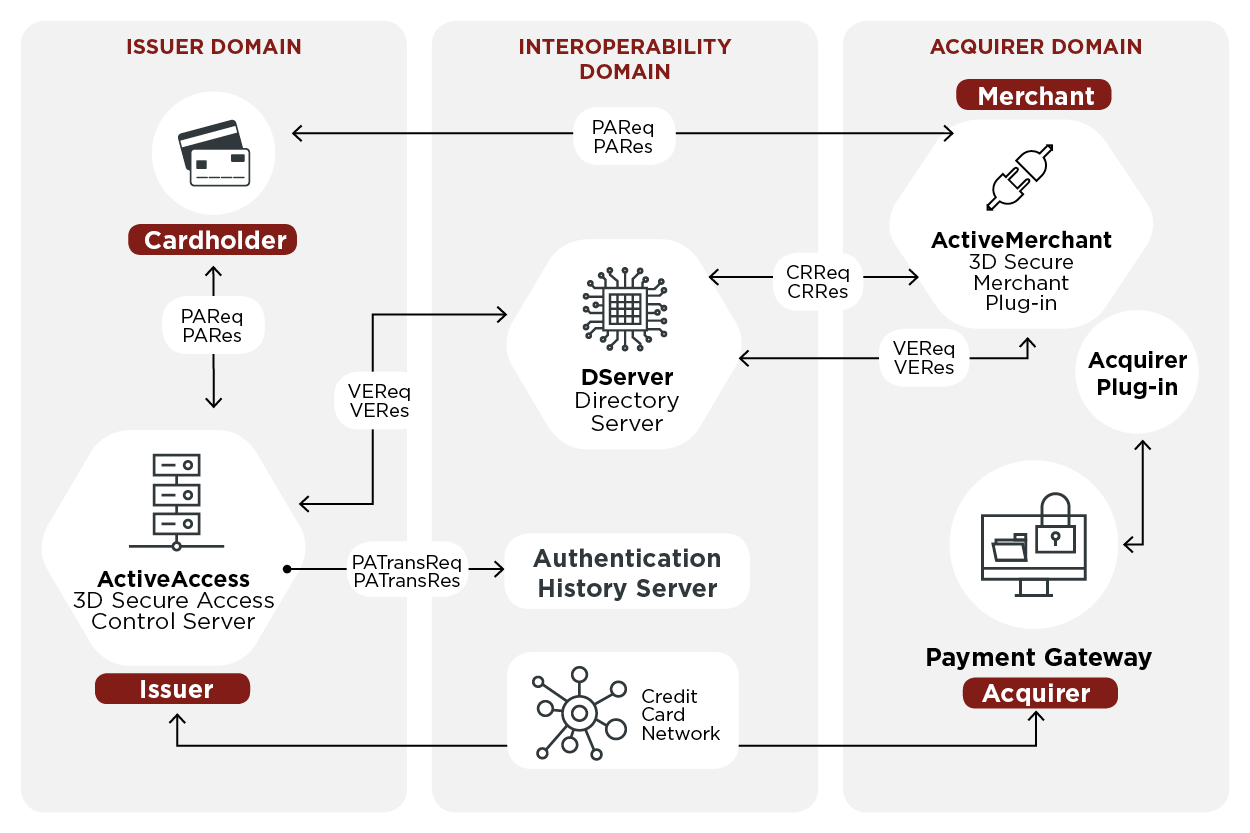

3D Secure, often referred to as 3DS, is an additional layer of security for online credit and debit card transactions. It was developed to authenticate the cardholder and ensure that the person making the transaction is indeed the card's rightful owner. The "3D" in 3D Secure stands for "Three-Domain Secure," which involves three parties in the authentication process:

1. The Issuer: This is the bank or financial institution that issued the card to the cardholder.

2. The Acquirer: This is the bank or financial institution that processes the payment on behalf of the merchant.

3. The Interoperability Domain: This is the domain where the authentication takes place, often controlled by the card networks like Visa, MasterCard, or American Express.

So, how does this work in practice? When you make an online payment with a 3D Secure-enabled card, you may be prompted to enter a one-time password (OTP) or a security code sent to your mobile phone. This adds an extra layer of security beyond just entering your card details.

The importance of 3D Secure payment lies in its ability to significantly reduce the risk of fraudulent transactions. By verifying the identity of the cardholder, it helps prevent unauthorized use of cards, protecting both consumers and merchants from potential losses.

How Does a 3D Secure Payment Work?

Now that we have a basic understanding of what 3D Secure payment is, let's delve into how it works. Here are the key steps involved:

- Initiation: The online shopper selects their desired items and proceeds to the checkout page. Upon entering their card details, the payment request is sent to the merchant's acquiring bank.

- Authentication Request: The acquiring bank, on receiving the payment request, checks if the card used is enrolled in 3D Secure. If it is, the authentication process begins.

- Cardholder Verification: The cardholder is redirected to their card issuer's website or a separate 3D Secure authentication page. Here, they may be asked to enter a one-time password (OTP) or other verification details.

- Authorization: Once the cardholder's identity is confirmed by their issuer, an authentication result is sent back to the acquiring bank. If the authentication is successful, the payment is authorized, and the transaction proceeds.

- Completion: The cardholder is directed back to the merchant's website, and the transaction is completed. A confirmation message is displayed, and the order is processed.

- This multi-step process happens seamlessly in the background, ensuring that the online payment is both convenient and secure. It's akin to having a virtual bouncer at the entrance of an online store, checking IDs to make sure only authorized individuals get in.

Pros and cons of 3D Secure Payments

Pros:

- Enhanced Security: The primary advantage of 3D Secure is its ability to reduce the risk of unauthorized card usage, protecting consumers from fraudulent transactions.

- Lower Chargeback Rates: Chargebacks, which can be costly for merchants, are less likely when 3D Secure is in place. This means fewer disputes and potential losses.

- Global Acceptance: 3D Secure is widely accepted across the globe, making it a reliable security measure for international transactions.

Cons:

- Friction in Checkout: Some users find the additional authentication step inconvenient and time-consuming, potentially leading to cart abandonment.

- Limited Adoption: Not all cardholders and merchants are enrolled in 3D Secure. This can create inconsistencies in the user experience and security levels.

- False Positives: In rare cases, legitimate transactions may be flagged as suspicious, causing inconvenience for the cardholder.

It's important to note that while 3D Secure adds an extra layer of security, it's not foolproof. Users should still exercise caution when making online payments and ensure they are on secure websites.

Difference between 3D Secure and 3D Secure 2.0

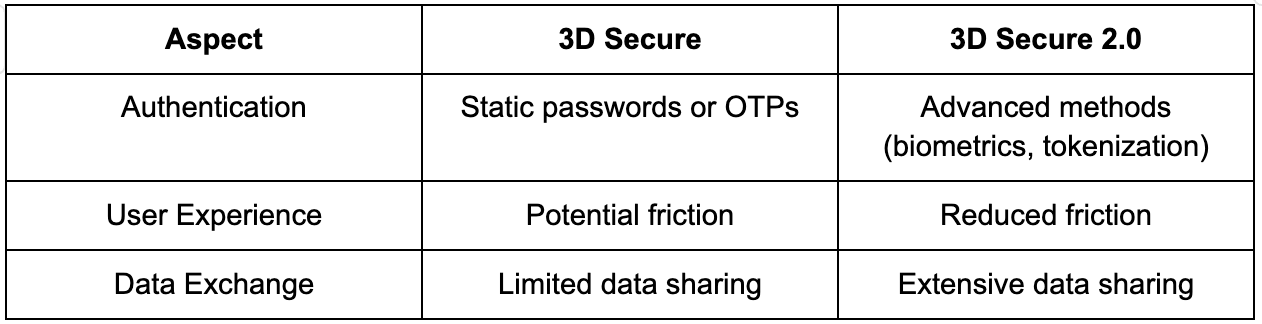

3D Secure:

- Authentication: Relies on a static password or a one-time password (OTP) for cardholder verification.

- User Experience: May require users to remember and enter passwords, leading to friction during checkout.

- Data Exchange: Limited data sharing between merchants, issuers, and card networks.

3D Secure 2.0:

- Authentication: Utilizes advanced authentication methods, including biometrics and tokenization, for a more seamless and secure experience.

- User Experience: Aims to reduce friction by using risk-based authentication, minimizing the need for static passwords.

- Data Exchange: Allows for extensive data sharing between parties, enabling better risk assessment and fraud prevention.

What are the benefits of using 3D Secure?

- Enhanced Security: As mentioned earlier, 3D Secure provides an additional layer of security, making it more challenging for unauthorized users to make online purchases with stolen card information.

- Reduced Chargebacks: Merchants benefit from reduced chargeback rates, as 3D Secure transactions are less susceptible to disputes.

- Global Acceptance: 3D Secure is recognized and accepted worldwide, making it a valuable tool for businesses engaging in international e-commerce.

- Compliance: It helps businesses comply with industry regulations and standards related to online security.

- Improved Customer Trust: Offering 3D Secure reassures customers that their transactions are secure, which can boost trust and confidence in your online store.

- Fraud Prevention: By sharing data among parties, 3D Secure helps identify and prevent fraudulent transactions in real time.

- Adaptability: With the introduction of 3D Secure 2.0, businesses can enjoy improved security without causing unnecessary friction in the checkout process.

Overall, the benefits of using 3D Secure extend to both consumers and merchants, creating a safer and more reliable online payment ecosystem.

Why Does Your Business Need a 3D Secure Payment Gateway?

If you're still wondering why your business should invest in a 3D Secure payment gateway, consider the following reasons:

- Risk Mitigation: Protect your business from losses due to fraudulent transactions and chargebacks. 3D Secure acts as a shield against unauthorized card usage.

- Compliance: Ensure that your business complies with industry regulations and security standards. Failure to do so can result in fines and reputational damage.

- Customer Trust: Offering 3D Secure reassures customers that their personal and financial information is secure when they shop on your platform, enhancing their trust in your brand.

- Global Expansion: If you're eyeing international markets, 3D Secure is a valuable tool for building trust with customers from different regions.

- Reduced Operational Costs: Fewer chargebacks mean lower operational costs related to dispute resolution and potential refunds.

- Improved Conversion Rates: With 3D Secure 2.0, you can reduce friction during the checkout process, potentially increasing conversion rates and revenue.

By implementing a 3D Secure payment gateway, you not only protect your business but also enhance the overall shopping experience for your customers, leading to increased loyalty and growth.

Frequently Asked Questions (FAQs)

Q: How do I register my debit card for 3D Secure?

A: To register your debit card for 3D Secure, you typically need to contact your card issuer or bank. They will guide you through the registration process, which may involve setting up a secure password or linking your card to a mobile app for authentication.

Q: How do I know if my card is 3D Secure?

A: You can find out if your card is 3D Secure by checking with your card issuer or examining the card itself. Many 3D Secure cards have the "Verified by Visa" or "MasterCard SecureCode" logo on them. Additionally, you may receive a one-time password (OTP) during online transactions if your card is 3D Secure-enabled.

Q: Is 3D Secure mandatory for all online transactions?

A: No, 3D Secure is not mandatory for all online transactions. Whether it's required depends on your card issuer and the policies of the merchant you're transacting with. However, it's highly recommended for added security.

3D Secure payment is a robust and essential tool in the world of online transactions. It provides an additional layer of security, reduces the risk of fraud, and enhances the trust of both consumers and businesses in the e-commerce ecosystem. With the advent of 3D Secure 2.0, the future promises even more secure and frictionless online payments. So, the next time you make an online purchase, rest assured that 3D Secure is working behind the scenes to protect your financial interests, allowing you to shop with confidence in the digital age.