In today's fast-paced interconnected financial landscape, the world of money transfer options has expanded significantly. Two popular methods that people often come across in the US for money transfer are Wire Transfers and ACH Transfers. But what sets these two apart? How do they work? And when should you choose one over the other? In this comprehensive guide, we'll dive deep into the realms of Wire and ACH transfers, demystifying the differences and helping you make informed choices.

What is ACH Transfer?

ACH stands for Automated Clearing House, and it's a network that facilitates electronic payments and transfers in the United States. ACH transfers are electronic fund transfers between banks, and they are widely used for various purposes, including direct deposits, bill payments, and business-to-business transactions.

Nacha (National Automated Clearinghouse Association) sets the rules for the ACH network, which managed 23 billion transactions worth $51.2 trillion in 2018. It's important to note that credit card payments operate through distinct networks.

How Does It Work?

ACH transfers operate by connecting two banks through a secure network. Here's a simplified breakdown of how it works:

- Initiation: The process begins with the initiation of the ACH transfer. This can be done through various channels, including online banking platforms, mobile apps, or in-person at a bank.

- Authorization: The person or business initiating the transfer must provide authorization for the ACH transaction. This usually involves confirming the details of the transaction, including the amount to be transferred and the relevant bank account information.

- Originating Depository Financial Institution (ODFI): The ODFI is the financial institution that facilitates the ACH transfer on behalf of the sender. It collects the necessary information, verifies the authorization, and initiates the ACH transaction.

- ACH Operator: The ACH operator acts as an intermediary that manages the clearing and settlement of ACH transactions. In the United States, Nacha is the organization responsible for the ACH network.

- ACH Network: The ACH network processes the transaction by transmitting the payment information from the ODFI to the Receiving Depository Financial Institution (RDFI).

- Receiving Depository Financial Institution (RDFI): The RDFI is the recipient's bank, where the funds will be deposited. It receives the payment information from the ACH network.

- Notification: The RDFI notifies the recipient (account holder) of the incoming funds. This notification may come in the form of a bank statement, online banking alert, or another method depending on the bank's communication practices.

- Posting: The funds are posted to the recipient's account, making them available for use. The timing of when the funds become available can vary, but ACH transfers are typically completed within 1-3 business days.

- Settlement: The ACH network facilitates the settlement process between the ODFI and RDFI, ensuring that the funds are transferred from the sender's account to the recipient's account.

- Confirmation: Both the sender and the recipient receive confirmation of the completed ACH transfer. This confirmation may be provided through bank statements, online banking notifications, or other means.

Example of ACH Transfer

Every month, when your employer deposits your salary directly into your bank account, it's likely done through an ACH transfer.

Here's how it works: Your employer, acting as the Originating Depository Financial Institution (ODFI), initiates the transfer through their bank. The ACH network processes the transaction, forwarding the payment details to your bank (the Receiving Depository Financial Institution or RDFI). You receive a notification from your bank, confirming the deposit. The funds are posted to your account, and the ACH network ensures the settlement between your employer's bank and yours, making your salary available for your financial needs.

What is Wire Transfer?

Wire transfers, often referred to simply as "wire," are electronic transfers of funds between different banks or financial institutions, and they can be used for both domestic and international transactions.

To initiate a wire transfer, the sender provides their bank with specific information about the recipient's bank, such as the bank's name, account number, and routing number, along with the amount to be transferred.

Unlike ACH transfers, wire transfers are typically faster and often processed on the same day, allowing for quick availability of fundsWire transfers are known for their speed and security, making them a popular choice for high-value transactions.

How Does It Work?

Wire transfers operate differently from ACH transfers:

- Initiation: The sender initiates the wire transfer, typically at their bank or through online banking.

- Authorization: The sender provides authorization for the wire transfer, confirming details such as the recipient's bank information, account number, and the transfer amount.

- Originating Bank (Sender's Bank): The sender's bank, or originating bank, collects the necessary information and initiates the wire transfer. A fee may be charged for this service.

- Wire Transfer Request: The originating bank sends the wire transfer request through the U.S. wire transfer network.

- Recipient's Bank (Receiving Bank): The wire transfer reaches the recipient's bank, or receiving bank, which processes the transaction based on the provided information.

- Notification to Recipient: The recipient is notified of the incoming funds, often through a bank statement, email, or other communication from their bank.

- Funds Posting: The funds are posted to the recipient's account, becoming available for withdrawal or other transactions.

- Confirmation: Both the sender and recipient receive confirmation of the completed wire transfer, detailing the transaction and the credited amount.

- Settlement: The wire transfer network facilitates the settlement process between the originating bank and the recipient's bank, ensuring the actual transfer of funds.

In the U.S., wire transfers are commonly used for various purposes, including business transactions, real estate transactions, and other situations where a fast and secure transfer of funds is required. Fees may apply, and the process is typically completed within the same business day.

Examples of Wire Transfer

Let's say you're purchasing a house in another state, Your bank will swiftly transfer the funds to the seller's bank, ensuring a secure and timely exchange.

Imagine buying a house and you need to transfer a substantial amount of money to the seller. A wire transfer is the ideal choice for such a high-value, time-sensitive transaction. After the deal is sealed, the seller provides their bank details. You, as the buyer, visit your bank and initiate a wire transfer to pay the purchase amount. Your bank (originating bank) processes the transfer, utilizing the U.S. wire transfer network. The funds swiftly reach the seller's bank (receiving bank), and they receive a notification of the incoming funds. Once the seller confirms the receipt, the transaction is complete.

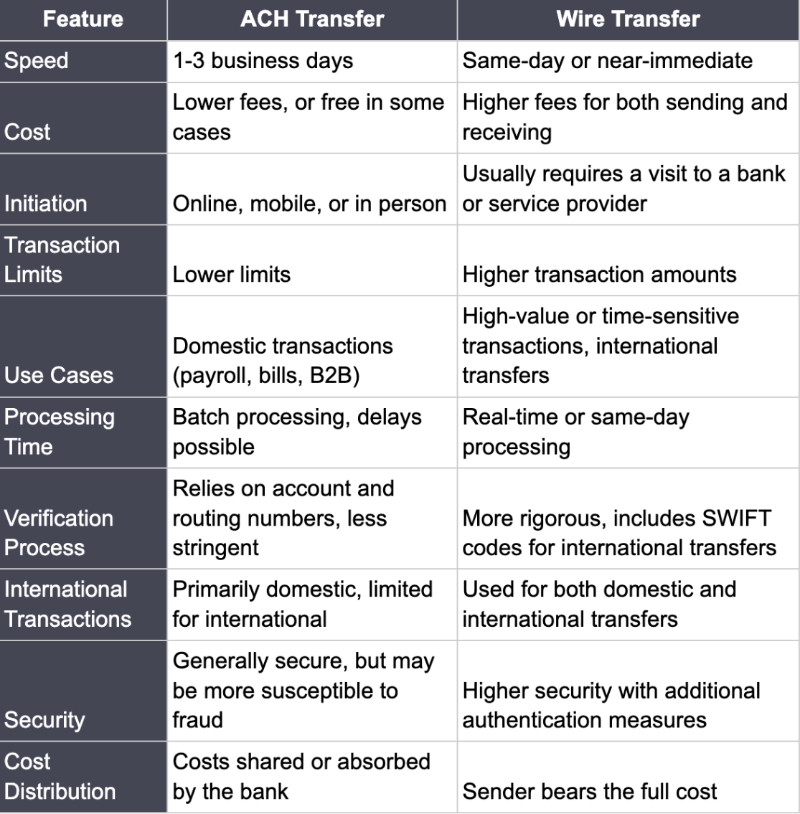

Difference Between ACH and Wire

Now that we've explored the fundamentals of ACH and wire transfers, let's highlight the key differences between the two:

In the world of electronic fund transfers, ACH and wire transfers each have their unique strengths and purposes. ACH transfers are excellent for routine, lower-value transactions with less urgency, while wire transfers shine when speed, security, and higher values are paramount. Understanding the differences between the two will empower you to make the right choice for your specific financial needs.

FAQs

- How Much Does an ACH Transfer Cost? The cost of an ACH transfer can vary depending on your bank or financial institution. Some banks offer ACH transfers for free, while others may charge a nominal fee. It's essential to check with your bank or review your account terms to determine the exact cost.

- Are Wire Transfers Safe for International Transactions? Yes, wire transfers are considered a secure method for international transactions. The stringent verification processes and use of secure networks, such as SWIFT, make wire transfers a reliable choice for transferring funds across borders. However, it's crucial to use reputable banks and financial institutions for international wire transfers to minimize the risk of fraud.

- How Long Does a Wire Transfer Take? Wire transfers are known for their speed. In most cases, domestic wire transfers are completed within a few hours, while international wire transfers may take slightly longer, typically one to five business days, depending on the destination and intermediary banks involved.

These frequently asked questions provide additional clarity on ACH and wire transfers, helping you navigate the world of electronic fund transfers with confidence.