Imagine a world where sending money is as easy as sending a text message. That's the idea behind automated clearing houses (ACHs), an important part of the financial system in the United States that helps make electronic fund transfers quick and simple. ACH is run by an organisation called Nacha (National Automated Clearing House Association) also known as ACH network or ACH scheme.

Understanding how ACH clearing works is important for businesses and regular people, as it ensures that electronic transactions happen smoothly and securely in today's fast-paced financial world. This article explores ACH clearing, explains how it works, why it's important, and how it's different from other ways of making payments.

How Automated Clearing House Works?

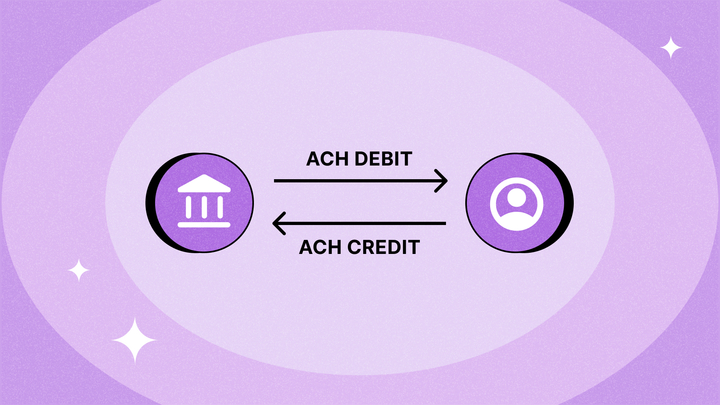

ACH clearing acts as a behind-the-scenes mediator for electronic transactions.

When you initiate an ACH payment, such as a direct deposit or bill payment, the originating financial institution (your bank) sends the transaction details to the Automated Clearing House Association (ACHA). The ACH network then verifies the account information and ensures sufficient funds are available. Once verified, the ACH transfers the funds to the receiving financial institution, completing the transaction. This is a simpler and faster way to move money compared to older methods like using checks.

What are the alternatives to ACH?

Although ACH payments are widely used, there are other payment methods available to suit various preferences and requirements. Here are a few examples.

Credit cards offer convenience and buyer protection but come with higher transaction fees for businesses.

Debit card payments are similar to ACH payments in terms of fund transfer speed, but the funds are deducted directly from your checking account balance.

Wire transfers are ideal for urgent transactions with larger sums, but typically incur higher fees compared to ACH transfers.

Mobile payment options provide contactless transactions with enhanced security features. The best payment method for you depends on factors like transaction speed, cost, security needs, and customer preferences.

The Importance of Automated Clearing House in Financial Transactions

ACH clearing is vital for the seamless functioning of the financial system due to several key contributions.

Firstly, ACH transfers are notably faster than traditional checks, enabling swift settlements that enhance cash flow management for businesses.

Secondly, the automated clearing house network employs robust security measures to authenticate account information and prevent fraudulent transactions, ensuring secure transactions.

Thirdly, ACH payments provide a cost-effective method for electronic fund transfers compared to alternatives such as wire transfers.

Lastly, the ACH system's scalability allows it to manage a high volume of transactions, making it suitable for businesses of all sizes.

Overall, ACH clearing facilitates secure and efficient electronic fund transfers, playing a foundational role in ensuring the smooth operation of numerous financial transactions daily.

Automated Clearing House Explained: Role and Function

An Automated Clearing House (ACH) is like a central control center for handling electronic money transfers between banks. It makes sure that the transfers happen smoothly and securely, and that all the banks involved are in sync with each other. Let's take a look at what it does in detail.

One, the ACH verifies account details and confirms adequate funds in the sender's account before approving the transfer. Two, once verified, it facilitates the seamless transfer of funds between the originating and receiving financial institutions. Three, the ACH Association (ACHA) establishes and enforces regulations that govern ACH transactions, ensuring a secure and standardized process.

By efficiently managing these essential tasks, ACHs play a crucial role in maintaining the smooth operation of the electronic payments ecosystem.

Automated Clearing House Process Example: A Detailed Illustration

Let's illustrate the ACH clearing process with a real-world example.

Imagine you set up a recurring direct deposit for your paycheck. Here's what happens behind the scenes.

- Initiation: Your employer initiates an ACH payment through their bank, sending your salary information to the ACH network.

- Verification: The ACH verifies your bank account details and confirms sufficient funds are available in your employer's account.

- Settlement: Once verified, the ACH transfers the designated amount from your employer's account to your bank account.

- Notification: Your bank receives the notification and updates your account balance, reflecting the deposited salary.

This process happens electronically, typically within 1-3 business days, ensuring you receive your paycheck efficiently.

Ways In Which Hyperswitch Helps You With The Clearing Process

Hyperswitch recognizes the critical importance of a seamless ACH clearing process for businesses and offers a comprehensive suite of solutions to optimize financial operations.

1. ACH Payment Processing: Integrate Hyperswitch's secure platform to efficiently initiate and receive ACH payments. This integration eliminates manual processes, saving time and resources. With a user-friendly interface, all ACH transactions can be managed conveniently from one centralized location.

2. Real-time Transaction Monitoring: Gain clarity and control over finances with real-time tracking of ACH transactions. Monitor transaction statuses, settlement dates, and identify any potential errors promptly. Detailed reporting tools provide insights that help optimize cash flow management.

3. Fraud Prevention Tools: Hyperswitch provides advanced fraud prevention measures to protect businesses from unauthorized transactions. Security protocols include identity verification and continuous transaction monitoring, ensuring robust protection of financial data.

By partnering with Hyperswitch, businesses benefit from a faster, more secure, and more efficient ACH clearing process. This allows them to focus more effectively on core operations and growth initiatives.