Businesses today need to streamline payouts to partners, vendors, and staff. Whether you're a seasoned entrepreneur or just starting out, understanding the two main methods - bank payouts and card payouts - is essential. This guide will delve into the advantages and considerations of each approach, empowering you to choose the best payout method for your business needs.

Understanding Payouts: Bank vs. Card

Bank payouts directly deposit funds into the recipient's bank account. This traditional method is widely used for salaries, refunds, and general disbursements. The payer must have the recipient's bank account details, including account number and routing information (like ACH routing number for domestic transfers or IBAN/international bank account number for international transfers). Bank payouts are generally secure and reliable, offering a clear audit trail for financial records.

Scenario: Acme Inc., a web design company, must pay its freelance web developer, Sarah Jones, for her recent project. Acme Inc. initiates the bank payout through its online banking platform or a payment processor. The company uses a bank payout to send the funds directly to Sarah's bank account.

To do this, they'll need to provide Sarah's bank account details, including her account number and routing number (typically for domestic transfers within the US). Acme Inc.'s bank verifies the accuracy of the provided bank account information to ensure the funds reach the intended recipient. Once the information is verified, Acme Inc.'s bank electronically transfers the agreed-upon payment amount to Sarah's bank account. Sarah will see the payment reflected in her account within 1-3 business days (depending on the banks involved). She will receive a notification from her bank about the deposit.

On the other hand, card payouts transfer funds directly to a debit or prepaid card. This method is gaining traction due to its speed and convenience. For card payouts, the payer needs the recipient's card information, including name, card number, and expiration date. Card payouts are often used for faster refunds, incentive programmes, or situations where the recipient might not have a traditional bank account. Notably, some card payout options can provide instant access to the funds for the recipient.

Scenario: RideAlong, a ridesharing service, wants to offer instant cashback rewards to riders who use their service for the first time. RideAlong decides to use card payouts to credit the cashback directly to the riders' debit cards. After a rider completes their first RideAlong trip, the company's system automatically triggers a card payout for the pre-determined cashback amount. RideAlong securely transmits the rider's debit card details (obtained during account signup) to their payment processor. The payment processor verifies the card information to ensure validity and sufficient funds for processing fees. Upon successful verification, the cashback amount is instantly deducted from RideAlong's account and securely transferred to the rider's debit card network. Since it's a card payout, the rider receives the cashback almost immediately. They might see a notification on their phone from their bank about the added funds, and the cashback will be reflected in their available card balance.

Exploring Bank and Card Payouts

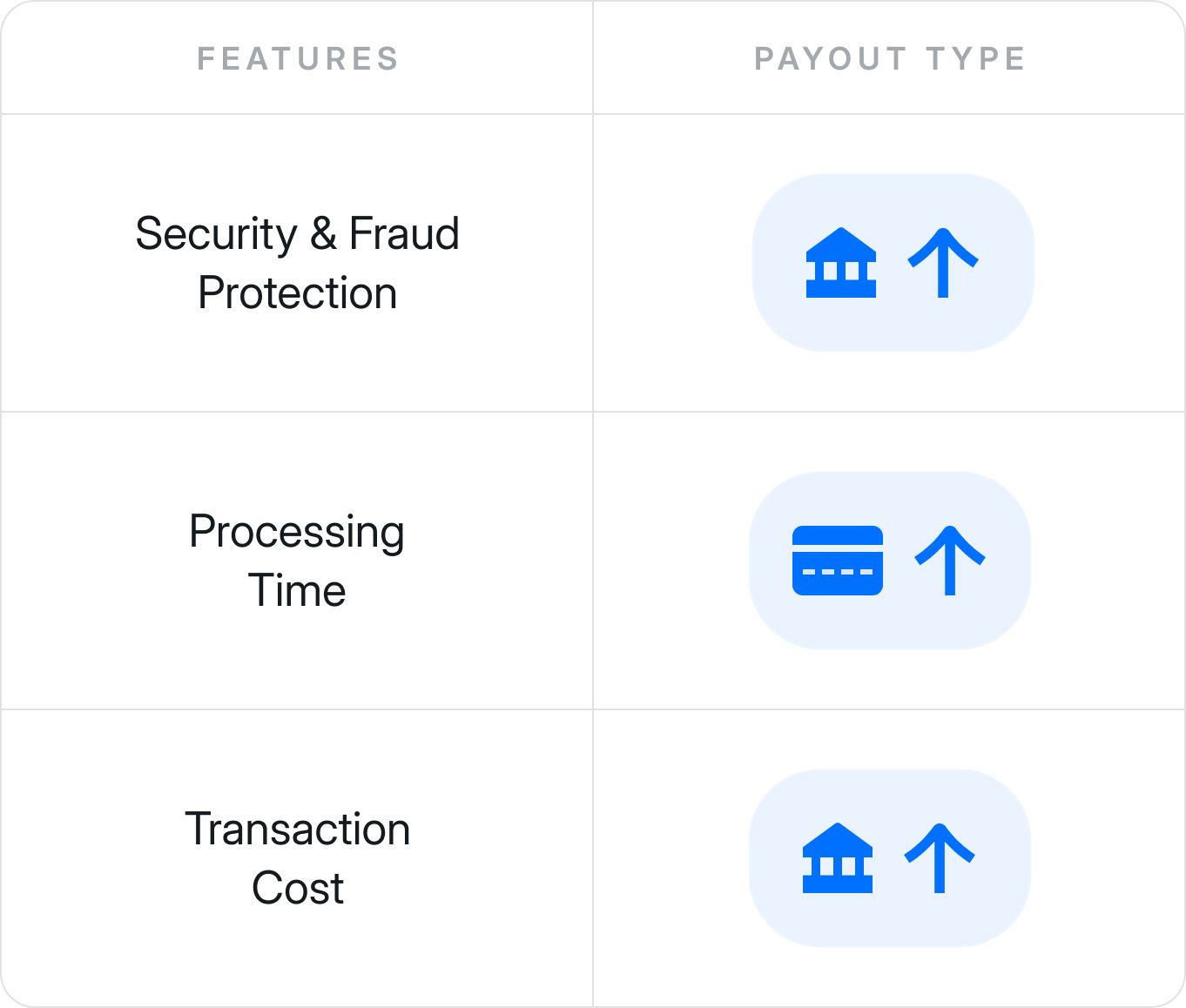

Bank payouts offer several advantages. They are typically considered a more secure method, with well-established fraud protection mechanisms employed by banks. Additionally, bank payouts often come with lower transaction fees compared to card payouts. However, processing bank payouts can take longer, especially for international transfers.

While bank transfers offer security and cost benefits, they can be slower than card payouts, particularly for international transactions. For domestic transfers, the funds typically move between the payer's and recipient's banks. For international transfers, additional intermediary banks might be involved, which can add processing time. Banks need time to verify account details, ensure sufficient funds, and complete the settlement process before crediting the recipient's account. This can take 1-3 business days domestically and even longer for international transfers.

Card payouts provide an alternative with faster processing times, particularly for domestic transactions. In some cases, the recipient can access the funds immediately. This can benefit businesses that need to expedite payouts, such as reimbursing travel expenses or offering instant rewards. However, card payouts may incur higher transaction fees compared to bank transfers.

While card payouts offer speed and convenience, they often come with higher transaction fees than bank transfers. Card networks may charge processing fees for each transaction. These fees can be a percentage of the transaction amount or a flat fee, depending on the network and card type (debit vs. credit). Some payment processors might add their own fees on top of the card network fees for facilitating card payouts.

Ultimately, the best payout method for your business depends on your specific needs and priorities. Consider factors like transaction speed, fees, security, and recipient preferences when making your decision.

Demystifying Payouts at Hyperswitch

At Hyperswitch, we understand the complexities of managing global payouts. We offer a comprehensive payout solution that empowers businesses to seamlessly send and receive funds domestically and internationally.

Our platform simplifies payout processing for both bank transfers and card payouts, allowing you to choose the most suitable method for each transaction.

Hyperswitch offers competitive foreign exchange rates and transparent fee structures, ensuring cost-effectiveness for your business.

Additionally, our robust platform provides real-time tracking and detailed reporting on all your payouts, giving you complete control and transparency.

Whether you require traditional bank transfers or the speed of card payouts, Hyperswitch is your one-stop solution for streamlined and secure global payouts.